Posted on April 18, 2018 by Christabelle Harris

On Friday the 6th of April, our staff participated in the GeersSullivan Amazing Race through the city to welcome in the firm’s 15th birthday.

It was a very competitive team building event with the overall winners of the day being Team ‘Back to the Futrli’ consisting of Chris, Vicky, Piera-Lee, Josh and Ida, and was concluded by a celebratory lunch at Prince Lane.

Share this:

Posted on by Christabelle Harris

If you are an Australian resident and are thinking of moving overseas, or alternatively, if you are an Australian resident living overseas but thinking of moving back to Australia, what are the potential tax implications?

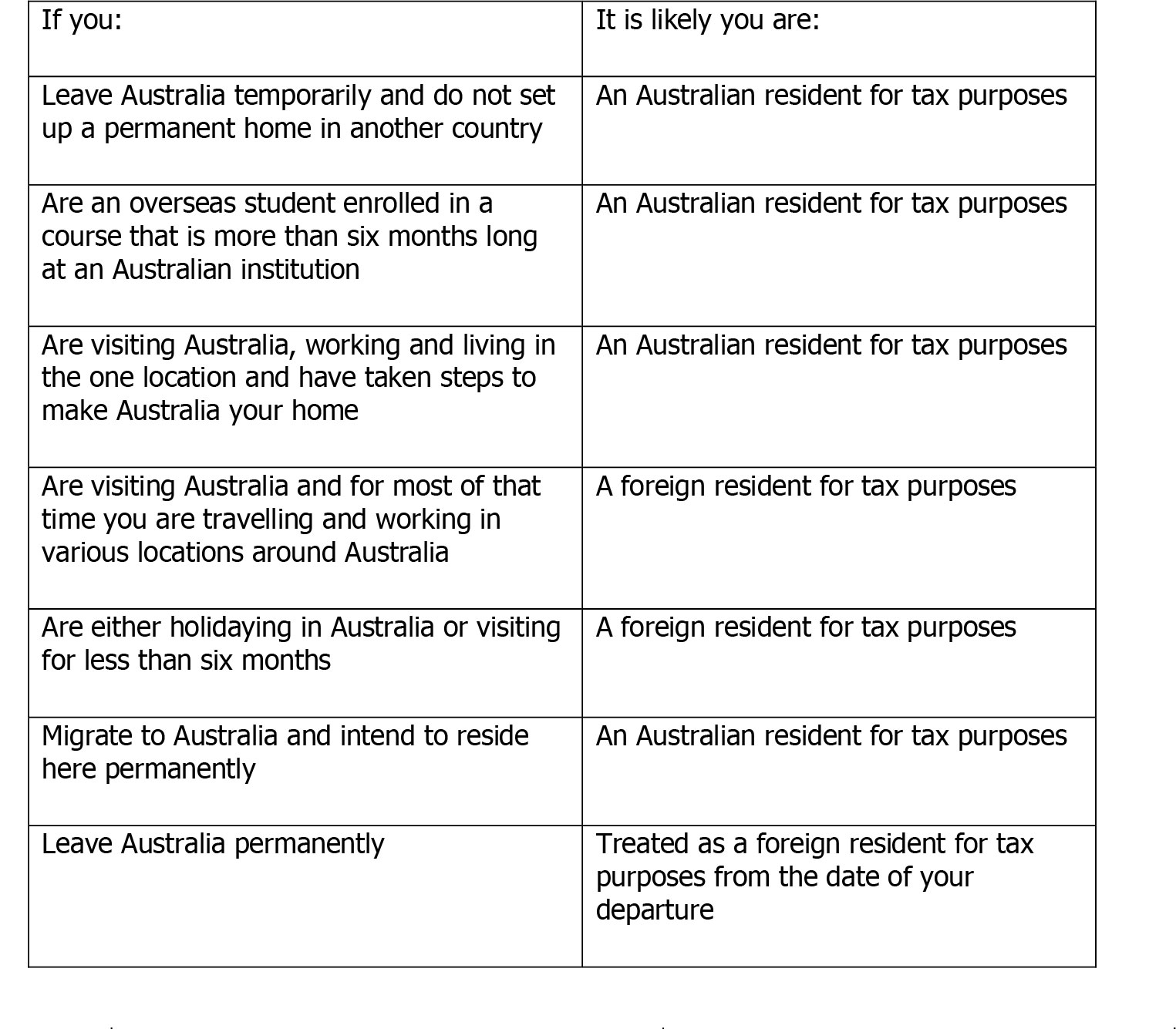

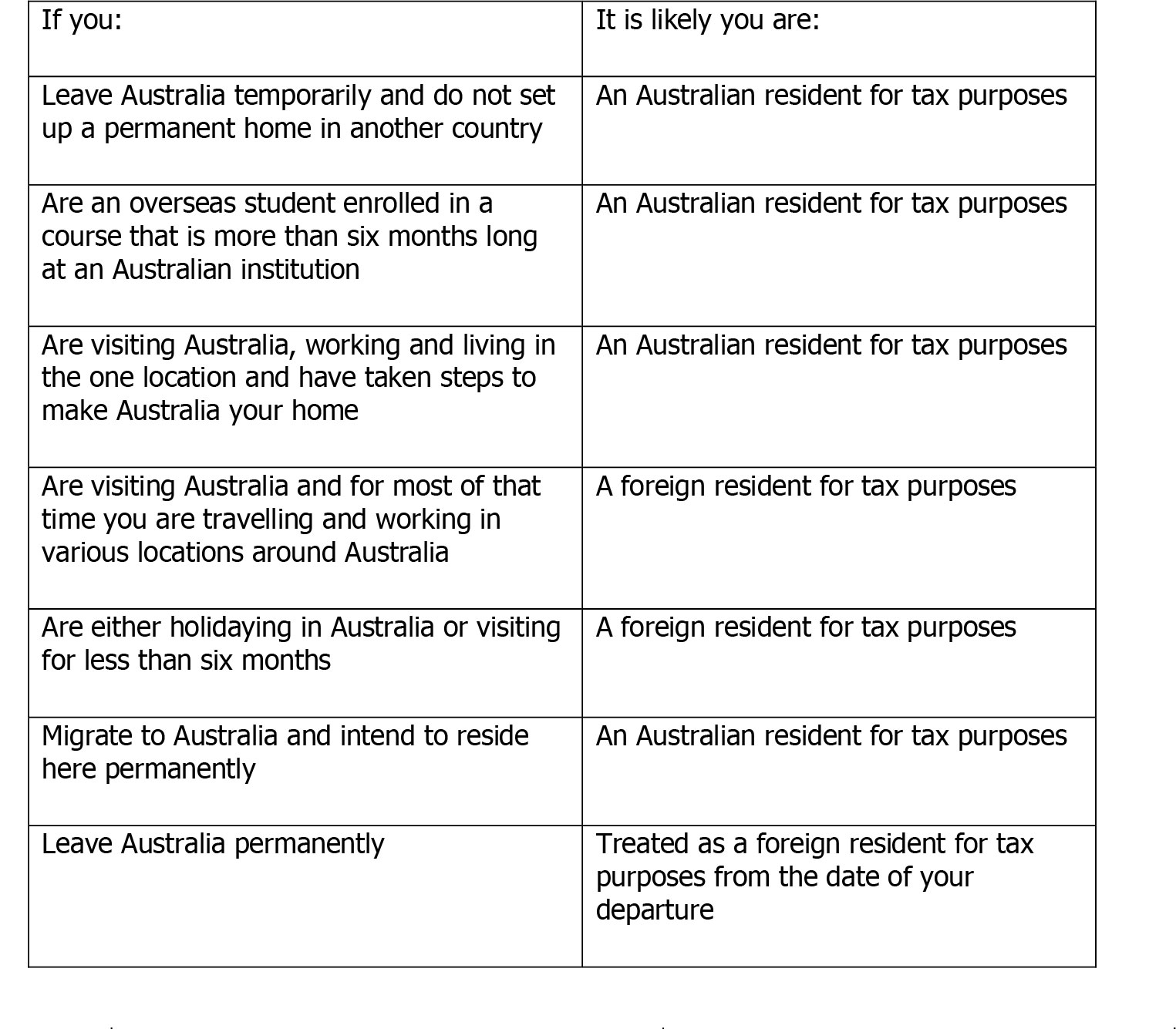

The first step is to determine whether you are an Australian or foreign resident for tax purposes. This may be different to your residency status for other purposes – for example, you may be an Australian resident for tax purposes even if you do not hold Australian citizenship or permanent residency.

Australian Residents for tax purposes

Tax implications of foreign income as an Australian resident for tax purposes?

As an Australian resident for tax purposes, all foreign sources of income must be declared in your tax return. This will include:

- foreign pensions and annuities

- foreign employment income

- foreign investment income

- foreign rental income

- foreign business income

- capital gains on overseas assets

It is likely that your foreign income will have been taxed in the source country that income was derived, potentially leading to double taxing of the same income. When completing your Australian tax return, any tax you have paid may be able to be claimed as a foreign income tax offset against your tax liability if there is a double agreement in place between the source country and Australia. There are also certain exemptions in place which you may be eligible for depending on your situation.

If you cease being an Australian resident for tax purposes

Foreign income tax implications if you are not an Australian resident for tax purposes?

You are only taxed on your Australian-sourced income, so you do not need to declare income you receive from outside Australia in your Australian tax return.

However, if you have a Higher Education Loan Program (HELP) or Trade Support Loan (TSL) debt and you’re a non-resident for tax purposes – you’ll need to declare your worldwide income or lodge a non-lodgement advice.

If you’re a non-resident you are not entitled to the tax-free threshold. This means you pay tax on every dollar of income you earn in Australia. If however, you were a resident for part of the year, you have a tax-free threshold of at least $13,464. The remaining $4,736 of the full tax-free threshold is pro-rated according to the number of months you were a resident.

CGT implications if you cease being an Australian resident for tax purposes?

If you have left Australia and kept your home as an investment, you may have potential Capital Gain implications. Changes to the current legislation were first announced in the 2017 Federal Budget which delivered a blow to foreign residents and expats with the removal of the Main Residence Exemption for foreign and temporary residents of Australia. Currently this legislation is before the Senate but it is expected that there will be no substantial changes to the proposed legislation.

The proposed legislation changes are that if you a non-resident on the date the contract of sale for an Australian property is signed (as opposed to settlement date), you will be subject to Capital Gains Tax (CGT) on 100% of the capital gain incurred. For existing properties held before 7:30pm on 9 May 2017 there are grandfather provisions available until 30 June 2019. It would be beneficial for any expat that still holds their main residence in Australia to seek advice in relation to whether they should sell their property prior to 30 June 2019, especially if there is any doubt that they will be returning to Australia to live before this date.

Share this: