SUPERANNUATION BUDGET UPDATE – SOME GOOD NEWS!

Posted on September 21, 2016 by Christabelle HarrisTreasurer Scott Morrison has confirmed changes to the Government’s superannuation package which includes scraping the proposed $500k lifetime cap on non-concessional contributions. If legislated, this was to come into effect from Budget night 3 May 2016 and captured non-concessional contributions made from 1 July 2007.

According to The Treasury website, the Government decided to amend the package to provide greater support for Australians investing in their superannuation with the primary objective of providing an income in their retirement.

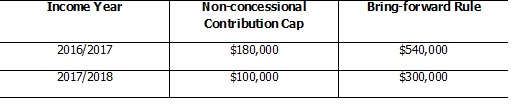

The new proposal scraps the lifetime $500k non-concessional cap and proposes a reduction to the existing annual non concessional cap from $180k to $100k per year, effective from 1 July 2017. The 3 year ‘bring forward’ provisions will still be available with the reduced cap for those under aged 65 years.

The new annual non-concessional caps will only be available to people with superannuation balances less than $1.6million. This is in place of the $500k lifetime non-concessional contributions cap previously proposed.

How does it work?

- The $1.6 million eligibility threshold will be based on your superannuation balance as at 30 June the previous year. This means if your balance at the start of the financial year (the contribution year) is more than $1.6 million, you will not be able to make any further non‑concessional contributions.

- If your super balance is close to $1.6 million, you will only be able to access the number of years of bring forward to take your balance up to $1.6 million.

- Transitional arrangements will apply. If you have not fully used your non‑concessional bring forward before 1 July 2017, the remaining bring forward amount will be reassessed on 1 July 2017 to reflect the new annual caps.

- If you are aged between 65 and 74, you will be eligible to make annual non‑concessional contributions of $100,000 if you meet the work test; that is gainful employment for 40 hours within a 30 day period each income year. As per current arrangements, you will not be able to access the three year bring forward of contributions.

The proposed measures to increase the flexibility for contributions for people aged 65 – 75 will not be proceeding. It was proposed that the contributions work test would be abolished from 1 July 2017.

For the current 2017 financial year, the $180k or up to $540k using the three year bring forward provisions apply.

Whether you are eligible to make non concessional contributions into super this financial year will depend on your age, whether you meet the work test and whether you have previously maximised the $540k within the previous 2 financial years. If you would like further clarification please contact our office.

If legislated the following non-concessional caps will apply to the 2018 financial year, the current caps are also included in the table below:

It is has been proposed by Treasury that individuals who triggered the non-concessional contribution bring forward rule in the 2015, 2016 or current financial year, and do not utilise the full bring forward amount before 1 July 2017, will no longer be able to utilise the full $540,000 cap. From 1 July 2017, any non-concession contributions made under the bring-forward rules will be based on the proposed 2018 non-concessional cap of $100,000.

Other changes previously proposed that if legislated, become effective from 1 July 2017 include:

Concessional Contributions – Employer and salary sacrifice contributions

Reduction to the annual cap on concessional (before‑tax) superannuation contributions to $25,000. Currently $30,000 under age 50; $35,000 for ages 50 and over.

Concessional contributions include personal concessional contributions (eg. Self-employed), employer and salary sacrifice amounts.

Improving access to concessional contributions

If you are under the age of 65, or aged 65 to 74 and meet the work test, you will be able to claim a tax deduction for personal contributions to super up to the $25k cap. This is designed to benefit those who are partially self-employed and partially wage or salary earners and those whose employers do not offer salary sacrifice arrangements.

Allowing catch-up concessional contributions

Effective from 1 July 2018 – If your superannuation balance is $500k or less, you will be able to rollover your unused concessional caps for up to 5 years to use if you have capacity and choose to do so.

For example – Melanie has a superannuation balance of $200,000 but did not make any concessional superannuation contributions in 2018‑19 as she took time off work to care for her child. In 2019‑20 she has the ability to contribute $50,000 into superannuation – $25,000 under the annual concessional cap and $25,000 from her un‑used 2018‑19 cap which has been rolled‑over.

Pension Accounts capped at $1.6 million

- There will be a $1.6 million transfer balance cap on the total amount of accumulated superannuation an individual can transfer into the tax‑free retirement phase. Subsequent earnings on balances in the retirement phase will not be capped or restricted.

- Savings beyond this can remain in an accumulation account where earnings are taxed at 15 per cent or outside the superannuation system.

- People already retired will have to bring their retirement phase balances under $1.6 million before 1 July 2017.

- The transfer balance cap will be indexed and will grow in line with CPI, meaning the cap will be around $1.7 million in 2020‑21.

Transition to Retirement Changes

The tax exempt status of income from assets supporting Transition to Retirement Income Streams will be removed. These earnings will now be taxed concessionally at 15 per cent. Individuals will also no longer be allowed to treat certain superannuation income stream payments as a lump sum for tax purposes.

Division 293 Threshold reduced

From 1 July 2017 the ‘division 293’ threshold will reduce from $300,000 to $250,000 per year meaning individuals earning over this amount will have to pay an additional 15% tax on concessional contributions.

Extending the Spouse Tax Offset

More taxpayers may also be able to access the 18% tax offset up to $540 if they make a contribution on behalf of their low-income spouse following a lift in the current $10,800 spouse income threshold to $40,000. The spouse receiving the contribution must be under age 70 and meet a work test if they are aged between 65 to 69.

Please don’t hesitate to contact our office should you require any additional information or have any queries concerning the changes.

Any information provided in this article is purely factual in nature and does not take into account your personal objectives, situation or needs. The information is objectively ascertainable and was not intended to imply any recommendation or opinion about a financial product. This does not constitute financial product advice under the Corporations Act 2001.