Posted on November 22, 2019 by GSCPA Admin

We have received a number of enquiries from clients seeking information on whether they qualify for a WA Seniors Card or Commonwealth Seniors Health Care Card and how to apply for them. We have summarised the key points for each entitlement and trust you may find this information useful.

WA Seniors Card – Department of Communities

Seniors Card Holders are entitled to a range of government concessions and discounts of 10% to 50% off the price of goods & services. The Seniors Card is combined with the Transperth SmartRider card allowing free travel on any Transperth bus, train or ferry at certain times on weekdays, concession fares at other times during the week and free travel all day Saturday, Sunday and public holidays.

The Seniors Card Benefits:

- Free off-peak travel as summarised above

- Entitled to receive a rebate of up to 25% on Water & Local Government Rate charges capped at $100 (50% rebate if you hold a WA Seniors Card and also a Commonwealth Seniors Health Card capped at $600 for Water Service Charges and $750 for Local government rates)

- Entitled to a 50% rebate on Driver’s licence

- A Directory from over 600 businesses is posted to all Seniors Card holders every 2 years and can be sourced online.

To qualify:

- To be eligible you need to be aged 63 years or above, please refer to the table below

- Working less than 25 hours per week of paid employment (averaged over 12 month period)

- Permanent Resident of Australia

|

Date of birth

|

Age to qualify for a WA Seniors Card |

|

Before 1 July 1955

|

60 years |

|

1 July 1955 to 30 June 1956

|

61 years

|

|

1 July 1956 to 30 June 1957

|

62 years

|

|

1 July 1957 to 30 June 1958

|

63 years

|

|

1 July 1958 to 30 June 1959

|

64 years

|

|

After 30 June 1959

|

65 years

|

The WA Seniors Card is a lifelong card that does not need to be renewed as long as the eligibility criteria are met.

- Application Form is available on the Department of Communities WA Seniors Card Centre website www.seniorscard.wa.gov.au.

- Download the Application Form from the above website or pick up a copy at the WA Seniors Card Centre or at your local Australia Post outlet

- Telephone 6551 8800 or 1800 671 233 (country free call)

- Email: info@seniorscard.wa.gov.au

Commonwealth Seniors Health Card – Department of Human Services

The Commonwealth Seniors Health Care Card is available to self-funded retirees who have reached Age Pension age (currently 66 years or older for both men and women) and who are not eligible to receive the Government Age Pension. This health card is subject to an adjusted taxable income test plus any deemed amount from account-based pensions. There is no assets test applicable.

If you hold a Seniors Card AND a Seniors Health Card you are entitled to receive:

- Up to a 50% rebate on annual Water and Council rate charges

- Discounts on Pharmaceutical Benefits Scheme (PBS) prescription medicines

- Government provides financial incentives for GPs to bulk-bill concession card holders

- Reduction in the cost of out of hospital medical expenses through Medicare Safety Net

- Concessional travel on Great Southern Rail services (The Ghan, Indian Pacific and The Overland)

To qualify:

- Reached Pension Age – currently 66 years or older.

- From 1 July 2019 the qualifying age for Age Pension will increase by 6 months every 2 years reaching 67 years by 1 July 2023.

- You do not qualify for the Age Pension or Veteran Affairs benefits

- Australian Resident

- As at 20 September 2019, have an annual adjusted taxable income of less than:

- $55,808 if you are single

- $89,290 for couples

- $111,616 couples separated due to ill health or respite care

Note :

Adjusted Taxable income is the sum of:

- Taxable income as per your personal Australian Taxation Office Notice of Assessment

- Add total net investment loss – eg. rental property and financial investment losses

- Add any foreign income received that wasn’t taxable

- Add the value of any employer provided benefits above $1,000 – eg. Car, Health Ins.

- Add reportable superannuation contributions and reportable fringe benefits

- If you are granted a Commonwealth Seniors Health Card on or after 1 January 2015, deemed income from an Account Based Pension entitlement including income deemed from an Account Based Pension owned by a card holder’s partner who is aged 60 years or more.

Deeming assumes that financials investments are earning a certain rate of income. The deeming rate applicable to an Account Based Pension entitlement from 1 July 2019 is as follows:

- For singles – 1% is applied to the first $51,800 of the Account Based Pension entitlement and anything over $51,800 is deemed to earn 3%

- For couples with at least one receiving an account based pension – 1% will apply to the first $86,200 of the combined value of the Account Based Pensions and 3% over and above $86,200

- For couples with neither receiving a pension, 1% will apply to the first $43,100 of your own and your share of jointly owned financial investments and 3% over and above $43,100

If your investment return is higher than the deemed income, the extra income doesn’t count towards your assessable income. You may be ab le to get a deeming exemption in some cases.

The Deeming rates are updated annually in July. Based on the above rates, if for example you have no other Taxable income, you can qualify for the Commonwealth Seniors card if you’re Account Based Pension entitlement/s are below the following:

- Single – Account Based Pension entitlement of $1,894,800 = deemed income of $55,808

- Couples – Combined Account Based Pension entitlements of $3,033,800 = deemed income of $89,290

There is no asset test applicable to the Commonwealth Seniors Card.

You can apply for a Commonwealth Seniors Health Card if you already have a Centrelink online account or through your myGov account linked to Centrelink. Otherwise print and complete the Claim for a Commonwealth Seniors Health Card form available on the Human Services website www.humanservices.gov.au/customer/forms/sa296

Alternatively please contact our office on (08) 9316 7000 if you need assistance with completing an application or if you are unsure if you qualify.

Share this:

Posted on October 25, 2019 by GSCPA Admin

Prior to 1 July 2017, Personal Concessional (deductible) Contributions had only been available to self-employed persons, or substantially self-employed persons meeting the 10% maximum earnings condition. Since 1 July 2017 however, both employees and self-employed persons have been able to make Personal Concessional Contributions with the 10% rule criteria removed. This means more people can claim a tax deduction for personal super if the conditions summarised below are met.

General conditions for claiming a tax deduction for personal super contributions

The following primary conditions must be met to be eligible to claim a tax deduction for a personal super contribution:

- A personal contribution must be made to a complying super fund for the purpose of providing super benefits

- The contribution is not made to one of the following types of complying super funds:

- a defined benefit interest in a Commonwealth public sector superannuation scheme

- an untaxed super fund

- The individual deducts the contribution for the income year in which the contribution is made

- The individual submits a valid notice to the fund trustee (further information is provided below)

- The fund trustee gives the member an acknowledgement of receipt of the valid notice

Additional conditions must be met if:

- the contribution was made prior to 1 July 2017 and the individual is an employee (10% rule applies)

- the individual is under age 18

Age-related conditions

If an individual is under the age of 18 at the end of the income year in which they make a contribution, to be eligible to claim a tax deduction for the super contribution, they must have derived income in the income year:

- from the carrying on of a business, or

- attributable to activities where they are treated as an employee for Superannuation Guarantee purposes.

If an individual is aged 65 to 74, they may need to satisfy the work test for the super fund to accept the contribution before tax deductibility can be considered.

A person passes the work test if they have been gainfully employed for at least 40 hours in a period of not more than 30 consecutive days in the relevant financial year.

Since 1 July 2019, individuals aged 65 to 74 with a total superannuation balance below $300,000 can make voluntary contributions for 12 months from the end of the financial year in which they last met the work test.

Additionally, from July 2020 a relaxation of the work test rules relating to contributions for individuals aged 65 and 66 has been proposed to allow voluntary superannuation contributions (both concessional and non-concessional) even if they do not meet the work test.

If an individual is aged 75 or more, the fund cannot accept personal member contributions, so the member is unable to make personal deductible contributions from age 75.

Important Considerations

Personal Concessional Contributions are subject to the concessional contributions cap (currently $25,000 per financial year). Personal Concessional Contributions must be considered in total with an individual’s other concessional contributions for the year, such as employer contributions.

An individual cannot create a tax loss by making a personal concessional contribution. This means the tax deduction that can be claimed in respect of a personal contribution is limited to the individual’s assessable income for the year, less other deductions.

An individual with a total superannuation balance of $1.6 million or more is not restricted from making personal deductible super contributions. However, if the deduction is denied by the ATO, the contribution will be re-classified as a non-concessional contribution. Individuals with a total superannuation balance of $1.6m or more are not eligible to make non-concessional contributions so if the contribution is denied as a personal concessional contribution, the contribution will be excessive and could incur additional tax.

An individual cannot claim a tax deduction for a downsizer contribution they make.

Valid notice of intent to claim (290-170 notice)

To be eligible to claim a tax deduction for a personal super contribution, or a part of a super contribution, an individual must provide the fund trustee with a valid notice of their intention to claim a deduction and the trustee must acknowledge receipt of the notice.

An example of the valid notice can be found at https://www.ato.gov.au/forms/notice-of-intent-to-claim-or-vary-a-deduction-for-personal-super-contributions/

The ATO form sets out the minimum data requirements however it is not compulsory to use the ATO version of the form. Notifications can be made to the super fund in various ways and funds may create their own form for their members to use.

The notice must be given to the trustee and acknowledged in writing before the earlier of:

- the day the individual lodges their income tax return for the income year in which the contribution was made, or

- the end of the next income year following the year of the contribution.

The notice is not valid in any of the following situations:

- the notice is not in respect of the contribution

- the notice includes all or part of an amount covered by a previous notice

- when the individual gave the notice:

- they were not a member of the fund, or

- the trustee no longer held the contribution, or

- the trustee had begun to pay an income stream based in whole or part on the contribution

- before the individual gave the notice:

- they had made a spouse contributions splitting application in relation to the contribution, and

- the trustee had not rejected the application.

Example

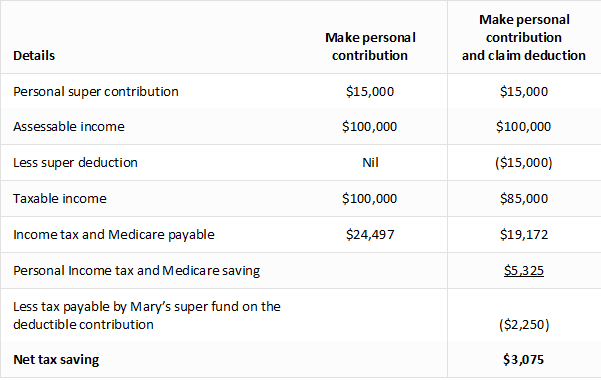

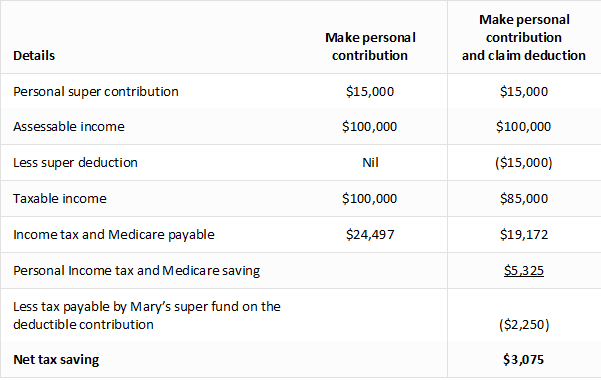

Mary, aged 55 qualifies to claim a tax deduction for personal contributions.

Mary earns $100,000 for a financial year as an employee. Mary’s employer contributed $10,000 and Mary also made a personal contribution of $15,000 to her super fund.

Mary claims all her personal contributions ($15,000 in total) as a tax deduction up to her concessional cap, which is $25,000. Both the employer contributions and the personal concessional contributions are counted towards the $25,000 cap. She notifies her super fund that she intends to claim a deduction for the personal super contribution and receives an acknowledgement from the super fund. Mary includes the $15,000 at D12 in her tax return.

By using this strategy, Mary will increase her super balance. Also, by claiming the contribution as a tax deduction, her personal tax saving is $5,325. The super fund pays 15% tax on the contribution so the net tax saving will be $3,075.

Please contact our Superannuation Manager Helen Cooper on (08) 93167000 should you wish to discuss your specific circumstances in more detail.

Any information provided in this article is general in nature and does not take into account your personal objectives, situation or needs. The information is objectively ascertainable and was not intended to imply any recommendation or opinion about a financial product. This does not constitute financial produce advice under the Corporations Act 2001.

Share this: