Posted on June 16, 2020 by Tashia Jayasekera

The classification between employee or contractor affects your tax, super obligations and could even bring about penalties if you get it wrong. It comes down to asking the right questions and weighing up the circumstances of your working arrangement.

What is the difference between an employee and a contractor?

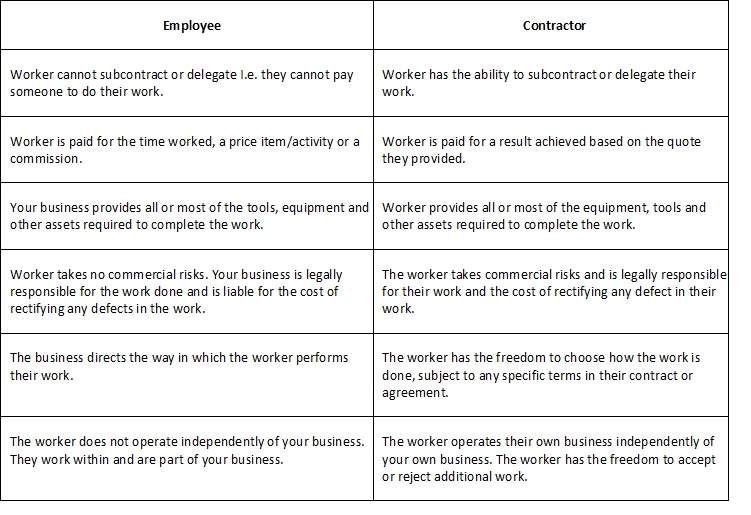

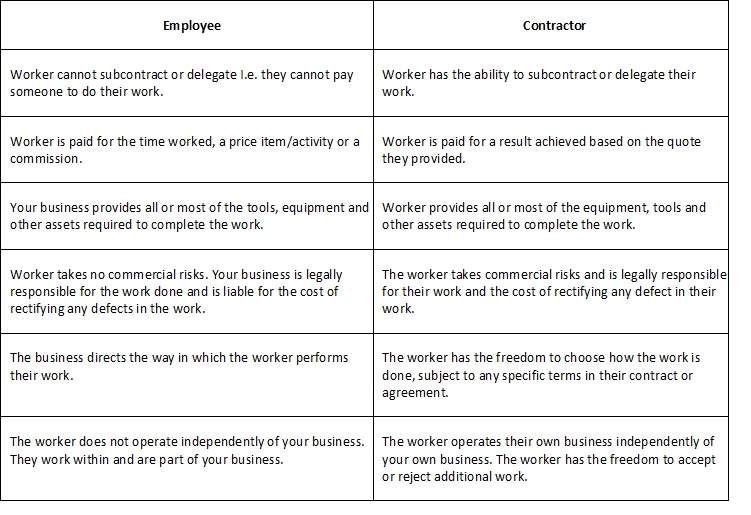

The table below outlines some of the main factors that can help you determine whether a worker is an employee or a contractor. These factors should be taken together as no one feature will guarantee that a worker is an employee.

Are any workers always employees?

Any of the following types of workers are always treated as employees:

- Apprentices

- Trainees

- Labourers

- Trades assistants

Apprentices and trainees can be full-time, part-time or school-based. They usually have a formal training agreement in place with the business they work for and are paid under an award and receive specific pay and conditions. The work arrangements for trainees and apprentices is always employment and you must meet the same tax and super obligations as you do for any other employees of your business.

Are any workers always contractors?

An employee must be a person. If you have hired a company, trust or partnership to do the work then it will be a contracting relationship.

What about labour hire arrangements?

If you have obtained a worker through a labour hire firm and pay that firm for the work performed at your business, then your business has a contract with the labour hire firm. The labour hire firm will be responsible for that worker’s PAYG withholding, super and Fringe Benefits Tax (FBT) obligations.

What are the tax and super obligations for an employee vs a contractor?

If your worker is an employee, you will need to:

- Withhold tax (PAYG withholding) from their wages and report this to the ATO

- Pay super at least quarterly to eligible employees

- Report and pay FBT if you provide your employee with fringe benefits

If your worker is a contractor:

- You do not need to withhold tax from their payments unless they don’t quote their ABN to you or you have a voluntary agreement in place with them

- You may still have to pay super for individual contractors if the contract is principally for their labour

- You do not have FBT obligations

What are the penalties for getting it wrong?

It is the against the law for a business to incorrectly treat their employees as contractors. Businesses that do this lower their labour costs by avoiding their tax and super obligations and denying workers their employee entitlements.

Some of the penalties and charges include:

- PAYG withholding penalty – for failing to deduct tax from worker payments

- Super guarantee shortfall amounts – the amount of super obligations that should have been paid to a complying super fund

- Interest charges

- Administration fees

- An additional super guarantee charge of up to 200%

If you have any questions about the employment or contracting relationship with any of your workers, please contact one of our Team on (08) 9316 7000.

Share this:

Posted on June 8, 2020 by Tashia Jayasekera

The Government has announced two new grants aimed at promoting investment in the WA residential market and stimulating jobs in the construction industry. These Building Bonus Package grants are available for people who enter into a contract to build a new home on vacant land or purchase a new home being constructed under a single-tier strata plan. The grant totals $20,000 for eligible participants. This is a flat amount regardless of how much you spend on building a new home.

The Building Bonus Scheme starts on 4 June 2020 and ends 31 December 2020. There is no cap on the purchase price or value of the contract nor is there any means testing for the grant. Multiple grants can be paid to the same applicant on separate transactions that meet the criteria for each grant.

The grant is available to owner occupiers, investors, Australian citizens, foreign persons, natural persons, corporations, and trustees. You do not need to be living in WA to access the grant. The grant is paid directly to the applicant rather than to the bank (if under a loan). Contracts signed before 4 June 2020 are not eligible for the Building Bonus grant.

Building a new home on vacant land

To be eligible for this grant, you must be the registered owner of the vacant land on which the home will be built. The grant will be paid to all registered owners unless there is written authorization to pay another person. This authorization must be provided by all the registered owners.

One grant will be paid in relation to each vacant lot of land regardless of how many homes will be built on the land.

The criteria include:

- The home to be constructed must be a detached residence i.e. it cannot share walls or roof structures with any other buildings.

- The home cannot be for mixed use, commercial purposes or short stay accommodation.

- The land must be vacant. If the land already has a building on it, the grant will only be paid after the building is demolished.

- The building contract must be in the name of the registered owner of the land.

- The contract must be entered into between 4 June 2020 and 31 December 2020.

- Construction must commence within six months of entering into the contract.

- If you are an owner builder, you must commence construction of the new home on the land between 4 June 2020 and 31 December 2020.

Applications for the grant can only be submitted once construction has commenced i.e. when the foundations of the home have been laid. Applications must be submitted by 30 June 2021.

Purchasing a new home being constructed under a single-tier strata plan

To be eligible, you must be the registered owner of the land on which the new home is built and you must be the buyer named in the off-the-plan contract. One grant will be paid in relation to each dwelling.

The criteria include:

- The home to be constructed must be part of a single-tier development.

- The home cannot be a replacement transaction. A replacement transaction is an agreement between the same parties as the cancelled transaction that is substantially similar in effect to the cancelled transaction.

- The home cannot be a completed dwelling that is held by the developer or another person.

- The home cannot be part of a refurbished development including those where the original property is extended or renovated.

- The contract must be entered into between 4 June 2020 and 31 December 2020.

- Construction must commence within six months of the contract date however you may apply to the Commissioner to extend the commencement date.

You may apply for the grant once construction has been completed and you are the registered owner of the property.

Access to the Building Bonus grant does not impact access to both State and Commonwealth grants, the existing $10,000 First Home Owner Grant and the first home buyer transfer duty concession for eligible first homebuyers.

If any of the new building packages impact you or you would like to discuss eligibility and application, please contact one of our Team on (08) 9316 7000.

Share this: