Posted on October 26, 2018 by Tom Francis

Division 7A is an area of tax law often mentioned and worried about by accountants and tax advisors, but generally not well understood by business owners. The legislation broadly covers the use of company money by shareholders without first declaring a dividend and was introduced in December 1997. Balances arising before this date are excluded from the measures.

Under the legislation amounts ‘borrowed’ from the company and used by shareholders for private purposes are deemed to be an unfranked dividend. This is obviously undesirable as it increases the taxable income of shareholders and simultaneously denies them the benefit of franking credits that could have accompanied a franked dividend.

Fortunately, the legislation also includes a mechanism whereby borrowed funds can be placed on a complying loan agreement, colloquially referred to as a “Division 7A Loan” or “s109N Loan”. Loans are principal and interest and can be in place for 7, 10 or 25 years.

In December 2009 the impact of the legislation was extended by the ATO to also cover unpaid trust distributions to companies, however these amounts could be placed on more flexible 7 or 10 year interest only loans. Again, balances that arose prior to December 2009 were excluded from the measures.

In both cases we have managed these ‘loans’ for our clients with an emphasis on smoothing and planning income levels each year while still complying with the requirements of the legislation. Generally, this is done through the declaration of dividends each year which are applied against the outstanding balances. This all appears about to change though as the Government flagged in the May budget that they intend to implement changes to Division 7A in line with recommendations from the Taxation Review Board.

The Government are yet to table any legislation on the matter but is expected that the following key changes will be made:

- Interest only loans will no longer be an option, all loans will be principal and interest with repayment benchmarks

- 7 and 25-year loans will no longer be an option and, of most concern,

- Amounts previously excluded as being pre-December 1997 and pre-December 2009 will now be caught by Division 7A

For these reasons we are seeking to proactively manage excluded amounts on our clients’ balance sheets as part of our compliance program in 2018. This approach will be most noticeable for clients with large balances currently excluded by the legislation. We believe that by addressing these issues sooner rather than later we can avoid sudden, large increases in tax that our clients have not planned for.

If you are concerned about your own Division 7A exposure or have friends and family who you believe are not being correctly advised in this area, we encourage you to contact us as soon as possible to discuss the above. For the vast majority of our clients there will be no noticeable change in the strategy for managing your tax affairs.

Share this:

Posted on June 11, 2018 by Tom Francis

Rental property owners are once again in the sights of the ATO in 2018 as they plan to crack down on landlords who wrongly claim tax deductions on their personal holiday homes. And they have some staggering figures to justify their interest, such as one Victorian tax payer who attempted to claim $760,000 of expenses on a property that was used by the tax payer and his friends for 87% of the year. The ATO were able to reliably estimate this figure based on the property’s listing on a holiday home website that clearly showed block out periods where the home was not available.

While the headlines are all about holiday homes, we believe tax payers who charge a low rate of rent to help family members such as kids studying full time can also expect some extra ATO scrutiny this year. This is because the ATO systems pick investigation targets based on ratios of income to expenses in the first instance and the ATO have shown a new willingness to issue ‘please explain’ letters en masse.

To help our clients manage this risk we implement the following strategies which can easily be applied to a holiday home or below-market rental:

Apportioning Your Expenses

Under this method the expenses claimed against your rental income are reduced by a percentage to allow for the private use component. We recommend this method where a property is rented at a market rate for part of the year and used privately (or leased out for no charge to friends and family) for the remainder.

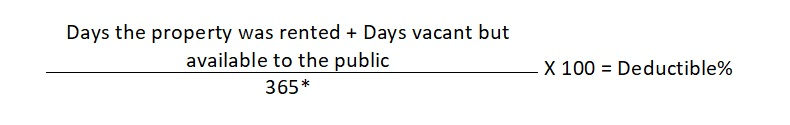

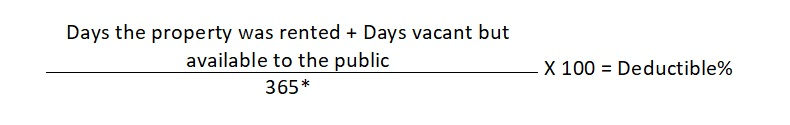

The formula to calculate the deductible percentage of your expenses is as follows:

The deductible percentage will apply to all expenses claimed against rental income in that financial year and is re-calculated each year based on occupancy.

Substitute a market rate of rent

Under this method the actual rent received is not included in your tax return, instead the expected rent from offering the property to the public for the full year is included. For example, a landlord with a property that should rent for $200 a week will include $10,400 as rental income in their tax return. No adjustment is made to the expenses incurred to maintain and operate the property, they are included in the landlord’s tax return as normal.

We recommend this method where:

- A property was rented at a below market rate to a related party (for example where Mum and Dad rent their property to their kids whilst they study at university for a cheap rate)

- A property was rented for part of the year to the public, part private use and partly to related parties without consideration for market value

- A property which had previously been a market rental is being used by a family member on a temporary basis and no rent is being charged

- No records have been kept as to the days available for rent to the public vs days of private use

It should be noted though that a property which has never been available for rent to the public cannot be treated as a rental if it is only used for private purposes. It is also possible for expenses incurred during a period of private use to be added to the cost base of an asset, so it is still important to keep accurate records each year.

*Where the property was purchased or sold during the financial year, this number will be the days the property was held during the year

Share this: