Posted on August 16, 2016 by Tom Francis

Legislation that was recently passed allowing small businesses to change their legal structure without incurring capital gains tax was touted by the Government as a simple solution for organisations that have experienced substantial growth since inception. Businesses started as a partnership or sole trader were now able to roll their operation into a new structure that would provide greater opportunities to grow further or access additional legal protections.

Unfortunately restrictions contained in the legislation have meant many small business owners, especially those who have been operating for several years already, are unable to take advantage of the new concessions.

However options do exist for entities locked out of the concessions and at GeersSullivan we have put together several successful strategies in the past few months utilizing the methods detailed below. Each method has been fully endorsed by the ATO as complying with current tax legislation or tested in the Court system, providing additional comfort that your affairs are within the letter and spirit of the law.

Corporate Beneficiaries

For businesses operating as a trust one of the major concerns is how to reduce tax on profits re-invested in the business. Setting up a corporate beneficiary allows profits to be taxed at the fixed corporate tax rate and retained within the business for up to 10 years. During this time we work with clients to actively manage their tax liabilities each year which results in a lower average rate of tax.

Service Trusts

For professionals such as doctors, pharmacists and lawyers, setting up a service trust allows the administration and retail function of the business to be separated from the professional and with it a share of the profits. These profits can be distributed to beneficiaries with a lower tax rate or the strategy can be combined with a Corporate Beneficiary to assist with profits being reinvested in the business.

Capital Re-structure

Companies remain a popular choice for operating a business due to their fixed tax rate, options to split ownership with unrelated partners and limited liability. With careful planning they can also be very flexible especially around admitting or retiring an owner. Share buy backs can be employed to exit an owner using a franked dividend where a capital gain is not practical. New shares are also able to be issued, subject to the value shifting limit, to an existing or new owner for no consideration without generating a tax liability. This is especially popular where a new owner brings necessary skills to a business rather than cash or assets.

Small Business CGT Concessions

While the whole-business rollover may not be available, the criteria for applying other small business CGT concessions can be lower and this can be used to move certain business assets from one entity to another without generating large tax debts. This concession also allows for tax effective super contributions to offset tax liabilities.

Economic conditions in Australia, and especially in Perth, are currently challenging and set to remain so for 12 months or more. For businesses struggling with a tough market the additional burden of an ineffective tax structure can be the straw that breaks the camel’s back. If you believe your structure is no longer suitable, we would like to hear from you and encourage you to contact your accountant to schedule a complimentary exploratory meeting to see if there is anything we can offer.

Share this:

Posted on April 15, 2016 by Tom Francis

It has been nigh on impossible recently to pick up a paper or open a news website without seeing an article or opinion on negative gearing. If all opinions are to be believed, this is simultaneously the greatest public enemy since communism and the sturdy ladder by which the hard working Australian slowly drags themselves up another rung.

With so many opinions and scare campaigns being touted by both sides of politics, it has become increasingly difficult to actually find anything out about negative gearing.

Gearing is the name given to the practice of borrowing funds to use for investment. For example if I have $10,000 and choose to borrow another $40,000 and invest that money in the share market, I have a geared investment. An investment is referred to as being positively geared where the income from that investment – so in my case dividends from my shares – exceeds the costs of holding that asset. In my example the costs to hold the asset will be the interest I pay on my loan. If the holding costs exceed the income derived from the underlying investment then my investment is negatively geared.

So why would I do this?

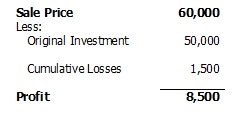

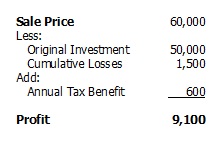

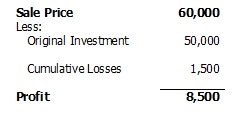

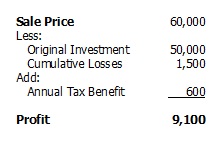

In the simplest of terms I am hoping to make a capital gain when I eventually sell my investment that exceeds my losses. For example I sell my share market investment after three years for $60,000; as the table shows I have made money on my investment despite having to put in $500 each year to cover my interest bill.

In the simplest of terms I am hoping to make a capital gain when I eventually sell my investment that exceeds my losses. For example I sell my share market investment after three years for $60,000; as the table shows I have made money on my investment despite having to put in $500 each year to cover my interest bill.

So where does the controversy come from?

Under Australian tax law I am able to offset the $500 loss I was making each year against my other income including my salary. This means I will have less assessable income and pay less tax. If we assume my tax rate was 40% I am paying $200 less tax a year.

But why is this controversial? It is readily accepted that you can deduct the cost of buying uniforms or using your car for work and the Government doesn’t have an issue with that cost. So why the outrage? What makes negative gearing so different to any other loss or outgoing?

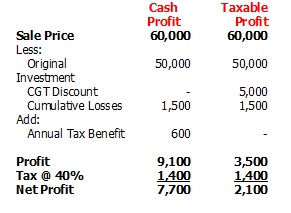

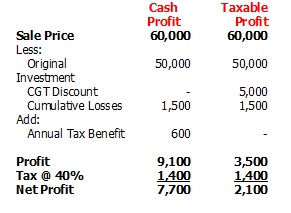

To answer that question we need to consider the application of the Capital Gains Tax Discount. Broadly speaking the discount reduces the taxable gain made when an investment is sold by 50% as long as the asset has been owned for over 12 months.

In relation to my parcel of shares that I held for three years I will only pay $1,400, an effective tax rate on my cash profit of 15%.

In relation to my parcel of shares that I held for three years I will only pay $1,400, an effective tax rate on my cash profit of 15%.

The changes proposed to tackle negative gearing are:

The Labor Party believes the answer is to only allow negative gearing on newly built houses. To be fair to existing landlords, any property that is already rented will also be allowed to continue to be negatively geared, a concept called grand fathering that is fairly common when taxes are reformed. Labor also plans to reduce the CGT discount so that there is less of an incentive to take on the gamble I have discussed above.

The Liberals have been more coy with their proposal and nothing is concrete yet however we should expect to see either a limit placed on the amount of losses that can be claimed each year or the number of properties that can be geared.

There are also a number of other proposals that have been put forward by various vested interests including:

- Do nothing, everything is fine the way it is

- Only allow investment losses to be offset by other investment income (quarantining)

- Reduce the CGT discount only, leaving negative gearing untouched

- Not allowing business or investment losses to be offset against salary and wages

Each of these has some merit and will likely be foisted upon us as the saviour as some point in the coming months. But until then I would like to conclude with the sobering thought that the Australian dream of owning your own home has become very expensive; any changes to the current system may ostracise investors resulting in their exit from the property market. The resulting devaluation of property is something both sides only want in moderation, even those pushing it as an agenda, as anything more could threaten our economic recovery for years to come.

Share this:

In the simplest of terms I am hoping to make a capital gain when I eventually sell my investment that exceeds my losses. For example I sell my share market investment after three years for $60,000; as the table shows I have made money on my investment despite having to put in $500 each year to cover my interest bill.

In the simplest of terms I am hoping to make a capital gain when I eventually sell my investment that exceeds my losses. For example I sell my share market investment after three years for $60,000; as the table shows I have made money on my investment despite having to put in $500 each year to cover my interest bill.

In relation to my parcel of shares that I held for three years I will only pay $1,400, an effective tax rate on my cash profit of 15%.

In relation to my parcel of shares that I held for three years I will only pay $1,400, an effective tax rate on my cash profit of 15%.