Special 2015 Budget Edition

Posted on May 13, 2015 by Chris GrieveOverview

Compared to prior years, the 2015 Federal Budget was comparatively light on in its content. Many of the announcements made on 12 May 2015 had been announced in some detail in the lead up to the Budget, and there really weren’t any hidden surprises.

The Government has again promised that “there will be no new taxes on superannuation under this Government”, and certainly there were no changes announced on Budget night. This should provide you with a level of comfort that the superannuation system will have a degree of stability for the next couple of years. In fact, the only superannuation announcement of note was a positive move to allow those suffering a terminal illness to access their superannuation savings earlier.

In many previous Budgets, it has been possible to group the announcements into three broad categories – taxation, superannuation and social security. This year’s Budget however provided a change, with the key categories of change being for small businesses, families and pensioners.

For small businesses, there were a number of tax concessions announced, such as accelerated depreciation, capital gains tax relief, fringe benefits tax exemptions and, perhaps most importantly, a reduction in the corporate tax rate. These changes have been designed to get small businesses moving quickly to help restore confidence and growth to the economy.

For families, the major change has been around the announcement of a new Child Care Subsidy which will replace the existing Child Care Benefit and Child Care Rebate. Many families will be better off under this new Subsidy, but it also comes with the Government’s controversial “no jab no pay” policy which effectively compels child immunisation.

For pensioners, new assets test thresholds and tapers will apply from 1 January 2017. This will lower the upper threshold at which age pension eligibility cuts out, and will result in a reduction in the level of payment for many pensioners.

If previous Budgets have taught us anything, it is that nothing is certain. Virtually all measures announced will still need legislation to be introduced, and will have to pass through Parliament, so the final version of the measures may differ to the announcements made in the Budget. We only have to think back to the 2014 Budget and announcements such as the co- payment for medical visit and changes to university funding as examples of significant measures that have not seen the light of day.

To ensure you take appropriate action at the right time, it’s important that you engage with your financial planner to ensure you stay abreast of developments that are important to you and your family as they happen.

Budget measures and announcements

Taxation measures

Accelerated depreciation for primary producers

Effective date: From 1 July 2016

All primary producers (eg farmers) will be able to claim an immediate deduction for the capital cost of fencing and water facilities, and claim depreciation over a shorter period of three years for capital expenditure on fodder storage assets (such as silos and tanks used to store grain and other animal feed).

Whilst this measure doesn’t reduce the actual amount outlaid for these items, the accelerated depreciation will result in a greater tax benefit up front for these primary producers (rather than having that benefit spread out over an extended period, in some cases up to 50 years).

Immediate deductibility for new business for certain start up costs

Effective date: From 1 July 2015

Currently, when a new business is established, some of the costs associated with that business are eligible for deduction over a period of five years. From 1 July 2015, the laws will be amended to allow these businesses to claim an immediate deduction for a range of professional expenses associated with starting a new business. Whilst not fully detailed, the expenses allowed for immediate deduction are expected to cover certain professional, legal and accounting advice.

Capital gains tax relief for small businesses that change entity structure

Effective date: From 1 July 2016

The Government will amend existing CGT provisions to allow a small business to change legal structure without attracting a CGT liability – ie will provide roll-over relief.

This provides an opportunity for those who set up a small business in a way that does not allow them to maximise small business CGT concessions on the future sale of eligible assets from that business, or on sale of the business itself.

Small business FBT exemption for work related electronic devices

Effective date: from 1 April 2016

Currently, an exemption from fringe benefits tax is available where an employee packages (or an employer provides) a portable electronic device (eg mobile phone, iPad, laptop etc). This exemption is currently available where an employee packages (or is provided) multiple devices provided that the devices perform substantially different functions.

From 1 April 2016, where this device is provided (or packaged) with a small business employer (ie aggregated annual turnover below $2M), this exemption will be available across all such devices that are primarily used for work purposes. This change recognises that with the evolution of technology, there is an increasing level of similarly in functions that can be undertaken by items such as smart phones, tablets and some laptops.

Accelerated depreciation for small business taxpayers

Effective date: Immediately (7:30pm AEST on 12 May 2015) until 30 June 2017

Small business taxpayers (those with aggregated annual turnover not exceeding $2million) will have the ability to claim an immediate tax deduction for assets that cost less than $20,000 if purchased and installed ready for use between Budget night and 30 June 2017.

Whilst this measure doesn’t reduce the actual amount outlaid for these items, the accelerated depreciation will result in a greater tax benefit up front for these small businesses.

Reduction in tax for small businesses

Effective date: 1 July 2015

From 1 July 2015, small business taxpayers operating via a corporate structure will have their corporate tax rate cut from the current 30% to 28.5%. This will apply to small business corporates with an annual aggregated turnover of below $2million. If the level of turnover exceeds this amount, the standard 30% corporate tax rate will apply to all of their taxable income (not just the amount in excess).

An additional concession is being provided to small businesses operating through an unincorporated business structure (eg through a partnership). Provided that business has aggregated turnover of less than $2million, individuals (eg partners in a partnership) will be eligible for a 5% discount on the tax payable on the business income received. This discount is capped at $1,000 per individual each year and will be provided via a tax offset (rather than a reduction in the level of income assessed).

Changes to treatment of meal entertainment and entertainment facility leasing expenditure

Effective date: 1 April 2016

The Government has announced a $5,000 cap on salary sacrificed meal entertainment and entertainment facility leasing expenses. Currently, employees of certain organisations, such as public benevolent institutions, public and not for profit hospitals and other not for profit organisations can package these benefits without attracting an FBT liability. This exemption will now be limited.

More importantly, the Budget paper also makes a statement that meal entertainment benefits will now be a reportable fringe benefit. Whilst this may not result in an increased liability for employers, if they are reportable for all employees (irrespective of the nature of the employer), you will need to be aware of this potential change, as the level of reportable fringe benefits is used in calculating eligibility for some benefits (such as the Government co-contribution to superannuation) or liability for additional taxes and levies (such as the additional 15% tax on superannuation contributions where a person’s taxable income exceeds $300,000.

Increase in the Medicare levy low income thresholds for families

Effective date: 1 July 2014

The Government has announced an increase in the new Medicare levy thresholds that are applicable for the current financial year (ending 30 June 2015). Unlike last year’s Budget, the increase will apply for singles as well as families.

The new threshold for singles is $20,896 (previously $20,542). For couples with no children, the new threshold will be $35,261 (previously $34,367). The threshold increases by $3,238 for each dependent child or student (the previous increase was

$3,156).

For single seniors and pensioners, the threshold will increase from $32,279 to $33,044.

Where your total income falls below the relevant threshold, no Medicare levy will be payable.

New method for calculating work-related car expense deductions

Effective date: 1 July 2015

Currently, there are four methods for calculating the amount of tax deduction for eligible work related car expenses. These are:

- The 12% of original cost method

- The 1/3rd of actual expense method

- The cents per kilometre method, and

- The log book method.

From 1 July, the first two methods will be abolished as less than 2% of those who claim work related car expenses used these methods. In addition, the current varying rates available (depending on engine size) under the cents per kilometre method will be changed to a single universal rate of 66 cents per kilometre. The log book method will remain unchanged.

As a result of this change, there will be some impact for those using the cents per kilometre method. The level of deduction will decrease for those with cars that have an engine size above 1.6 litres. Those whose have an engine size below 1.6 will not be impacted. It is also likely that employers who reimburse for employee travel on a cents per kilometre basis will also change their reimbursement ratios to the same level.

Superannuation measures

Release of superannuation for those suffering a terminal illness

Effective date: 1 July 2015

Currently, where a person has been diagnosed with a terminal illness and has two medical practitioners (including one specialist) certify that they are likely to pass away within 12 months, they are able to immediately access their superannuation savings tax free irrespective of their age. However, where a person has a terminal illness but is expected to live longer than 12 months, they need to wait before being eligible to access their super under this method.

As announced in the lead up to the Budget, the Government will legislate to increase the eligibility timeframe from 12 months to 24 months.

Social Security measures

Alignment of aged care means testing arrangements

Effective date: 1 January 2016

The Government proposes to include rental income from the home for both Social Security and Aged Care means tests where a person resides in aged care and pays periodic accommodation payments. The new rules will apply only to new entrants. Currently income from renting the home is exempt from both the Social Security and Aged Care means test. There is no change to the treatment of the home under the asset tests. The home remains a Social Security exempt asset for two years after the last member of a couple leaves, whilst under the aged care means test only a part of the value of the home is assessed.

Reduction in eligibility period for certain pension recipients whilst overseas

Effective date: 1 January 2017

From 1 January 2017, certain recipients of the Age Pension, Wife Pension, Widow B Pension and the Disability Support Pensions that are absent from Australia will have their eligible period for full payment reduced from 26 weeks to 6 weeks.

After the six week period, those who have lived in Australia for less than 35 years will be paid at a reduced rate. Those who have lived in Australia for more than 35 years (since the age of 16 until Age Pension age), or are otherwise exempt, will not have their payments reduced.

Those overseas at the time of commencement will not be affected unless they return to Australia and commence another overseas trip.

Cessation of the Large Family Supplement of Family Tax Benefit (FTB) Part A

Effective date: 1 July 2016

From 1 July 2016, the large family supplement paid to FTB Part A recipients will cease. This supplement is currently valued at $321.20 pa. Recipients will still remain entitled to receive a per child rate of FTB Part A for each eligible child in the family.

Widow Allowance excluded from ordinary waiting period

Effective date: 1 July 2015

Currently, a one week waiting period generally applies to eligible Allowance recipients before a benefit will be paid. From 1 July 2015, this one week waiting period will no longer apply to new applicants for the Widow Allowance.

Child Care Subsidy

Effective date: 1 July 2017

As announced prior to the Budget, a new Child Care Subsidy will come into effect from 1 July 2017, replacing the current Child Care Rebate, Child Care Benefit and the Jobs, Education and Training Child Care Fee Assistance.

This new Child Care Subsidy will be means and activity tested, paid directly to the family’s choice of approved service for up to 100 hours per fortnight and based on benchmark prices for a variety of child care services. Any difference between the subsidised amount of the benchmark price and the actual price charged by the service would be met by parents.

The subsidy will taper from 85% per child of the actual fee or the benchmark price, whichever is lower for family incomes of up to $60,000 in today’s dollars projected to be $65,000 by 2017, down to 50% of the fee for families earning up to $165,000 or more in today’s dollars which is projected to be approximately $170,000 or more in 2017. A cap on subsidies of $10,000 per child is to apply for families with income of $180,000 and above (projected to be $185,000 by 2017). This is more generous than the cap of $7,500 regardless of income that currently applies under the Child Care Rebate.

All child care subsidies and support will remain linked to immunisation requirements which from 1 January 2016 will be strengthened under the Government’s ‘no jab, no pay’ policy. The only exemption to this policy will be on medical grounds.

More generous means testing for youth payments

Effective date: 1 January 2016 – Parental Income Test Effective date: 1 January 2017 – Maintenance Income Test

From 1 January 2016, families with dependent children receiving income support payments are to be subject to the Parental Income Test arrangements currently in place for Family Tax Benefit (FTB) Part A and will no longer be subject to the Family Assets Test or Family Actual Means Test. The removal of these two tests will result in a more consistent level of support for families, as younger people move from FTB Part A to an individual income support payment.

From 1 January 2017, a Maintenance Income Test will be introduced for dependent children receiving individual income support payment. This test will apply to that child only and not include other child support amounts provided in relation to other children in the family.

Payment of Family Tax Benefit Part A whilst overseas

Effective date: 1 January 2016

Currently, when recipients of FTB Part A are overseas, they are eligible to receive payment at their full rate for 6 weeks, and then at a reduced (base) rate for a further 50 weeks. From 1 January 2016, FTB Part A will only be paid for six weeks in a 12 month period whilst the recipient is overseas.

Delay in increasing the eligibility age for Newstart Allowance and Sickness Allowance

Effective date: 1 July 2016

The eligibility age for Newstart Allowance and Sickness Allowance will increase to age 25 from 1 July 2016. In the 2014 Federal Budget it had been proposed to increase the eligibility age (from the existing age of 22) to 24 from 1 January 2015. This increase has now been delayed, and the eligibility age increased as a result.

Revised waiting period for youth income support

Effective date: 1 July 2016

The Government intends to scrap the unlegislated 2014/15 Budget measure requiring a person under age 30 to wait six months before being eligible for Newstart Allowance and instead require young people under age 25 years to actively seek work for a 4 week waiting period before receiving income support payments. Persons with a disability will be exempt.

Cessation of Low Income Supplement

Effective date: 1 July 2017

From 1 July 2017, the Low Income Supplement will cease to be paid. This supplement is currently valued at $300 per annum.

Recipients of most Government payments will continue to receive carbon tax compensation through the Energy Supplement.

“No jab no pay”

Effective date: 1 January 2016

As announced prior to the Budget, from 1 January 2016, families will no longer be able eligible for subsidised child care or the FTB Part A end of year supplement unless their child is up to date with all childhood immunisations.

Some exemptions may be provided on medical grounds.

Not proceeding with certain social security announcements from the 2014 Federal Budget

Effective date: Immediately

The Government has decided not to proceed with the elements contained in the 2014-15 Budget measure which relates to the pension income test free area and deeming thresholds. The pension income test free areas and deeming thresholds will continue to be indexed annually by CPI.

In addition, the Government has decided not to proceed with the 2014-15 Budget measure to reset the income test deeming rate thresholds from 30 September 2017. Previously, the Government had proposed to reset the deeming thresholds for assessing eligibility for welfare payments to $30,000 for singles and $50,000 for couples.

Changes to assets test thresholds and taper rates

Effective date: 1 January 2017

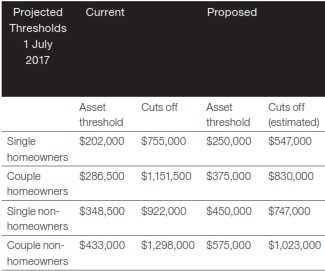

As announced prior to the Budget, the Government is proposing significant changes to the assets test for determining pension eligibility from 1 January 2017.

The proposed change will restore the existing taper rate of $1.50 pension reduction for every $1,000 above the relevant threshold, to the pre 2007 level of $3.00 for every $1,000 of assets above the threshold.

The measure, if passed will take effect from 1 January 2017 in place of the 2014 Budget measure currently in the Senate to index pensions from 1 January 2017 solely to CPI increases. As such pensions will continue to be indexed by the greater of CPI and the Pensioner and Beneficiary Living Cost Index plus benchmarked to a percentage of Male Total Average Weekly Earnings.

Importantly all people affected by the scaling back of the maximum asset threshold will be guaranteed eligibility for the Commonwealth Seniors Health Card (CSHC) or Health Care Card, which provides the same concessional access to pharmaceuticals as given to those on the pension.

The table below outlines the current and proposed thresholds:

Improving integrity of social security income test arrangements

Effective date: 1 January 2016

The deductible amount of an income stream payment is not counted as income under social security income tests. Defined benefit income streams are calculated on an employee’s length of service and final salary. Currently under social security income tests the tax free component of a defined benefit income stream is counted as the deductible amount. The Government proposes that the deductible amount of a superannuation defined benefit pension be capped at a maximum of 10 per cent of income.

Those receiving DVA pensions and military superannuation fund defined benefit pensions are exempt from this measure.

Those receiving defined benefit pensions may have reduced social security entitlements due to increased assessable income attributed to defined benefit income stream. The measure may also impact aged care residents as the defined benefit income is also assessed as income for aged care fees.

Other

Removing Double-Dipping from Parental Leave Pay

Effective date: 1 July 2016

The Government will remove the ability for individuals to effectively ‘double-dip’ when applying for the Governments Parental Leave Pay (PLP) scheme. Currently there is nothing preventing an individual from accessing Government assistance from the PLP in addition to any parental leave entitlements offered to them by their employer.