Posted on November 22, 2019 by Ashley Dawson

On 31 March 2020, AUSkeys that we are all currently using to access the ATO Business Portal or Tax Agent Portal will be replaced by myGovID. Currently myGovID technology is in public beta and only available on Apple iPhones but an Android app should be available sometime before the March 2020 deadline.

The myGovID is not the same as the myGov website, the myGovID is used to prove who you are when using online government services, similar to a bank hardware authenticator. Currently under the public beta version you are able to access the following government services with your myGovID:

- ATO Business Portal

- ATO Access Manager

- Australian Business Register (ABR)

Another government service that will be added soon to the public beta version is the ATO Online Services for Agents. More services will be added as they become available.

To obtain a myGovID you will need:

- To be 13 years or older

- iPhone 6 or above (in the near future this will also be available for Android)

- an email address that belongs to you (it should not be a shared email address)

- To prove your identity, you will need information from either your passport, Medicare card and/or drivers licence. Some services require you to confirm your identity with all three documents.

Steps to setting up your myGovID

- Download the myGovID app from the App Store

https://itunes.apple.com/au/app/mygovid/id1397699449?mt=8

- Open the myGovID app on your phone and follow the prompts to complete your full name, date of birth and email address.

- During the app setup you will need to provide details of your passport, Medicare card and/or drivers licence. You can do this by scanning these using your phone or entering the details manually into the fields provided. The app will then verify the details provided with the appropriate authority in a matter of seconds. By providing two of the documents details, such as the details from Medicare card and drivers licence, you will achieve the level of Standard identity strength, which will allow you to access all of the above listed services currently available through this system.

Next you will need to link your myGovID with your ABN through the Relationship Authorisation Manager (RAM) to access the online business services. RAM login can be found at https://authorisationmanager.gov.au/#/login and will allow you to complete the following tasks:

- link your business

- view and manage your business authorisations

- accept an authorisation request

- manage machine credentials

You will need to be a principal authority to link your business in RAM, which is someone that is responsible for the business, such as:

- a sole trader

- an eligible individual associate listed on an ABN in the Australian Business Register (ABR), for example a trustee, director, public officer, partner, or an office bearer of a club or association

Prior to trying to access RAM, please check your personal details and individual associates listed on the ABR are up to date.

Next log into RAM using your myGovID app to authenticate yourself and then follow the instructions below as to how to link your business to your myGovID:

- Select Link my business to be redirected to the ATO to find your business or businesses.

- Add your postal or residential address as held by the ATO and click Continue.

- Select the business or businesses (that you are an eligible individual associate for in the ABR) you wish to link from the list and click Continue.

- Enter an email address and click Send Email to receive an authorisation code (the email address can be different to the one used to set up your myGovID, for example, a work email address). Enter the code and then click Verify and Continue.

- View the summary of the selected business or businesses and select the checkbox to declare you understand and accept. Click Submit.

- A message will display confirming your business is successfully linked. Click Continue.

Once your business or businesses are linked to your myGovID then you as the principal authority in RAM can authorise others to act for your business. This includes setting up authorisation administrators, who can then set up authorisations for others.

In RAM either a principal authority or authorisation administrator can then create authorisations and assign levels of access for users, who are then able to act on your business’ behalf within the above listed online government services.

To setup authorised users, you first need to make sure that the user has completed their own myGovID process, then you need to have their full legal name as per their myGovID and their email address. This email address does not need to be the same email address that they used to set up their myGovID identity. For example, they may have used a personal email address for the myGovID setup and now they can use a work email address for the RAM user authorisation.

To add a new authorised user, you will need to be logged into RAM and complete the following steps:

- Select Manage authorisations

- Select the business you would like to add an authorised user to

- Click Add new user

- Next you will be prompted to provide the user’s name and email address

- Select the level of access you are granting them – full, custom or none

- Review the details and then complete the declaration

- If custom access has been selected for a user, then you will be redirected to the ATO’s Access Manager to set permissions for the user

- An authorisation request will now be sent to the user to accept.

Now you and your users will all be set up so that you can securely access the above government online services.

If you require help with setting up, accessing or authorising users through myGovID and RAM, please contact our office and one of our friendly accountants will be happy to help you through the process.

Share this:

Posted on October 25, 2019 by GSCPA Admin

Prior to 1 July 2017, Personal Concessional (deductible) Contributions had only been available to self-employed persons, or substantially self-employed persons meeting the 10% maximum earnings condition. Since 1 July 2017 however, both employees and self-employed persons have been able to make Personal Concessional Contributions with the 10% rule criteria removed. This means more people can claim a tax deduction for personal super if the conditions summarised below are met.

General conditions for claiming a tax deduction for personal super contributions

The following primary conditions must be met to be eligible to claim a tax deduction for a personal super contribution:

- A personal contribution must be made to a complying super fund for the purpose of providing super benefits

- The contribution is not made to one of the following types of complying super funds:

- a defined benefit interest in a Commonwealth public sector superannuation scheme

- an untaxed super fund

- The individual deducts the contribution for the income year in which the contribution is made

- The individual submits a valid notice to the fund trustee (further information is provided below)

- The fund trustee gives the member an acknowledgement of receipt of the valid notice

Additional conditions must be met if:

- the contribution was made prior to 1 July 2017 and the individual is an employee (10% rule applies)

- the individual is under age 18

Age-related conditions

If an individual is under the age of 18 at the end of the income year in which they make a contribution, to be eligible to claim a tax deduction for the super contribution, they must have derived income in the income year:

- from the carrying on of a business, or

- attributable to activities where they are treated as an employee for Superannuation Guarantee purposes.

If an individual is aged 65 to 74, they may need to satisfy the work test for the super fund to accept the contribution before tax deductibility can be considered.

A person passes the work test if they have been gainfully employed for at least 40 hours in a period of not more than 30 consecutive days in the relevant financial year.

Since 1 July 2019, individuals aged 65 to 74 with a total superannuation balance below $300,000 can make voluntary contributions for 12 months from the end of the financial year in which they last met the work test.

Additionally, from July 2020 a relaxation of the work test rules relating to contributions for individuals aged 65 and 66 has been proposed to allow voluntary superannuation contributions (both concessional and non-concessional) even if they do not meet the work test.

If an individual is aged 75 or more, the fund cannot accept personal member contributions, so the member is unable to make personal deductible contributions from age 75.

Important Considerations

Personal Concessional Contributions are subject to the concessional contributions cap (currently $25,000 per financial year). Personal Concessional Contributions must be considered in total with an individual’s other concessional contributions for the year, such as employer contributions.

An individual cannot create a tax loss by making a personal concessional contribution. This means the tax deduction that can be claimed in respect of a personal contribution is limited to the individual’s assessable income for the year, less other deductions.

An individual with a total superannuation balance of $1.6 million or more is not restricted from making personal deductible super contributions. However, if the deduction is denied by the ATO, the contribution will be re-classified as a non-concessional contribution. Individuals with a total superannuation balance of $1.6m or more are not eligible to make non-concessional contributions so if the contribution is denied as a personal concessional contribution, the contribution will be excessive and could incur additional tax.

An individual cannot claim a tax deduction for a downsizer contribution they make.

Valid notice of intent to claim (290-170 notice)

To be eligible to claim a tax deduction for a personal super contribution, or a part of a super contribution, an individual must provide the fund trustee with a valid notice of their intention to claim a deduction and the trustee must acknowledge receipt of the notice.

An example of the valid notice can be found at https://www.ato.gov.au/forms/notice-of-intent-to-claim-or-vary-a-deduction-for-personal-super-contributions/

The ATO form sets out the minimum data requirements however it is not compulsory to use the ATO version of the form. Notifications can be made to the super fund in various ways and funds may create their own form for their members to use.

The notice must be given to the trustee and acknowledged in writing before the earlier of:

- the day the individual lodges their income tax return for the income year in which the contribution was made, or

- the end of the next income year following the year of the contribution.

The notice is not valid in any of the following situations:

- the notice is not in respect of the contribution

- the notice includes all or part of an amount covered by a previous notice

- when the individual gave the notice:

- they were not a member of the fund, or

- the trustee no longer held the contribution, or

- the trustee had begun to pay an income stream based in whole or part on the contribution

- before the individual gave the notice:

- they had made a spouse contributions splitting application in relation to the contribution, and

- the trustee had not rejected the application.

Example

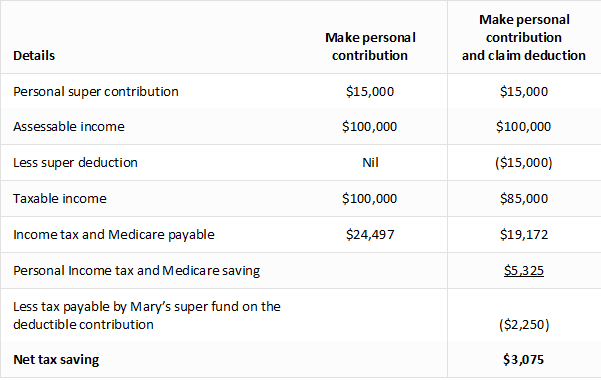

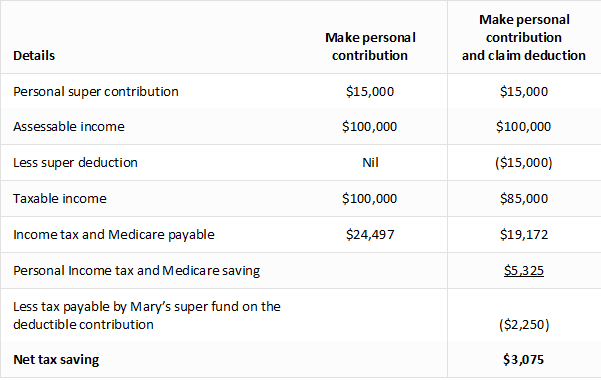

Mary, aged 55 qualifies to claim a tax deduction for personal contributions.

Mary earns $100,000 for a financial year as an employee. Mary’s employer contributed $10,000 and Mary also made a personal contribution of $15,000 to her super fund.

Mary claims all her personal contributions ($15,000 in total) as a tax deduction up to her concessional cap, which is $25,000. Both the employer contributions and the personal concessional contributions are counted towards the $25,000 cap. She notifies her super fund that she intends to claim a deduction for the personal super contribution and receives an acknowledgement from the super fund. Mary includes the $15,000 at D12 in her tax return.

By using this strategy, Mary will increase her super balance. Also, by claiming the contribution as a tax deduction, her personal tax saving is $5,325. The super fund pays 15% tax on the contribution so the net tax saving will be $3,075.

Please contact our Superannuation Manager Helen Cooper on (08) 93167000 should you wish to discuss your specific circumstances in more detail.

Any information provided in this article is general in nature and does not take into account your personal objectives, situation or needs. The information is objectively ascertainable and was not intended to imply any recommendation or opinion about a financial product. This does not constitute financial produce advice under the Corporations Act 2001.

Share this: