Posted on September 13, 2019 by GSCPA Admin

Leading up to our recent federal election there was a great hype around changes to our tax system, none more enticing than the promise that every day Australians could expect to receive an additional $1,080 back from their next tax return through the introduction of the Low and Middle Income Tax Offset (LMITO).

A tax offset does not operate like a deduction, which most people are more familiar with. A deduction is used to reduce your assessable income (total wages, interest, dividends received, etc.) down to your taxable income. Which is the amount your tax bill (payable) for the year is derived from. A tax offset is applied as a reduction to your tax payable, meaning that, per dollar, it is more effective at reducing your tax position.

Unfortunately, this promise was without reference to some of the grittier details which stripped back how many people would actually receive the full value of this extra offset.

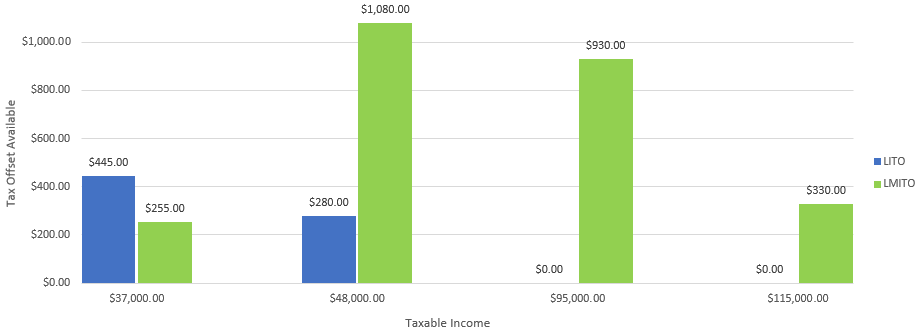

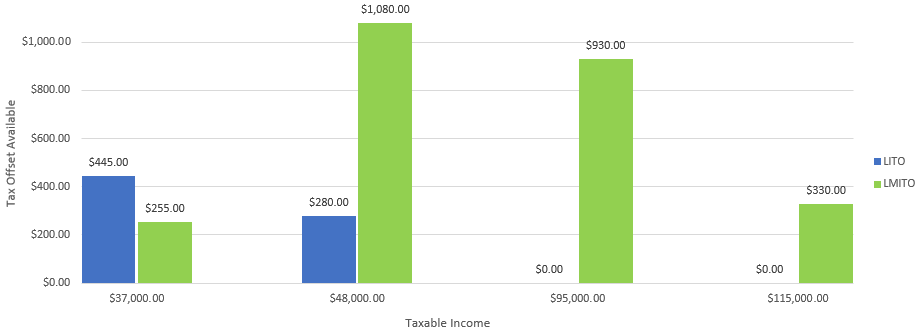

The offset operates in addition to the Low Income Tax Offset (LITO), which has been in place since 1993. The maximum offset available through LITO is $445, this applies if your taxable income is $37,000 or less. The offset however diminishes at $0.015 for every $1 your taxable income is over $37,000. Meaning it is fully depleted once your taxable income reaches $66,667.

Now with the new LMITO in place there is an extra offset available up to the value of $1,080 for taxpayers. It, like LITO operates on a sliding scale, but with multiple tiers added to its application. The first tier is for individuals with a taxable income less than $37,000, who will receive an extra $255 tax offset. The second tier is for taxable incomes between $37,000 and $48,000, who receive an offset of $255 plus $0.075 for every dollar their taxable income is over $37,000, up to $48,000, where you will be entitled to the full $1,080 tax offset. The full value of the offset is then held through the third tier up to a taxable income of $90,000, meaning that if your taxable income is between $48,000 to $90,000 you are entitled to the full $1,080 tax offset. However, once your taxable income exceeds $90,000 your offset entitlement is diminished by $0.03 of every extra dollar of taxable income, up until a taxable income of $126,000, when the offset has been completely diminished.

There are some drawbacks however, the offset is “non-refundable” meaning that if you don’t use the full value of your entitlement it’s not available as a straight up cash refundable amount. This would only occur if application of the offset reduced your taxable income to $0.00. Do remember that if you have another outstanding debt with the ATO or any Australian Government agency the ATO is required by law to remit your now larger refund toward these debts.

If you have any further questions regarding this new item please be in touch with your accountant at GeersSullivan on (08) 9316 7000.

Share this:

Posted on by GSCPA Admin

If you produce assessable income at home, or some of it, and you incur expenses from using that home as your “office” or “workshop”, the ATO will generally allow that a taxpayer could be in a position to be able to claim some expenses and make some deductions. Otherwise the ATO takes the view that expenditure associated with a person’s place of residence is more likely to be of a private nature.

| Home office expenses you can and can’t claim |

| Expenses |

Home is principal workplace with dedicated work area

|

Home not principal workplace but has dedicated work area |

You work at home but no dedicated work area

|

| Running expenses |

Yes

|

Yes

|

No*

|

| Work-related phone & internet expenses |

Yes

|

Yes

|

Yes

|

| Decline in value of office equipment |

Yes

|

Yes |

Yes

|

| Occupancy expenses |

Yes

|

No |

No

|

* Generally, an employee who works at home and who does not have a dedicated work area will not be entitled to claim running expenses or their claim for running expenses will be minimal. This is due to the fact that they can only claim the additional running expenses incurred as a result of working from home.

Running expenses

You can generally view running expenses as those costs that result from you using facilities in your home to help run the business or home office, so these would include electricity, gas, phone bills and perhaps cleaning costs. But again, you can only claim a deduction for the amount of usage from the business or home office, not general household expenses.

Using your floor area may be an appropriate way of working out some running expenses. For example, if the floor area of your home office or workshop is 10% of the total area of your home, you can claim 10% of heating costs.

Instead of recording actual expenses for heating, cooling or lighting, it may be easier to use the ATO’s “acceptable” rate for these expenses, which is 52 cents per hour based on actual use or an established pattern of use (from 1 July 2018, it was 45 cents before then).

To use the 52 cents per hour method of claiming, keep a diary to record the amount of time you use your home office for work purposes. The diary must show a representative period of at least four weeks to establish a pattern of use for the whole year. Remember to always keep these diaries with your tax return paperwork as you may be required to support this deduction should the ATO review your return.

Communications

If you use a phone exclusively for business, you can claim a deduction for the phone rental and calls, but not the cost of installing the phone. If you use a phone for both business and private calls, you can claim a deduction for business calls (including from mobile phones) and part of the rental costs.

If you have a bundled phone and internet plan, you need to identify your work use for each service over a four-week representative period during the income year. This will allow you to determine your pattern of work use which can then be applied to the full year.

A reasonable basis to work out your work-related internet use could include:

- the amount of data downloaded for work as a percentage of the total data downloaded by all members of your household;

- any additional costs incurred as a result of your work-related use – eg if your work-related use results in you exceeding your monthly cap.

Decline in value

There are deductions available for a “decline in value” (depreciation) of items such as electrical tools, desks, computers and other electronic devices, as well as for desk, chairs and so on.

If you use your depreciating asset solely for business purposes, you can claim a full deduction for the decline in value (generally over its “effective life”). Remember however that if you qualify as a small business you could immediately write off most depreciating assets that cost less than $25,000. However, if you also use the depreciating asset for non-business purposes, you must reduce the deduction for decline in value by an amount that reflects this non-business use. Talk to this office for more information about claiming depreciation expenses.

Deductions for occupancy

Occupancy expenses can only be claimed if you are using your home as a place of business, not just conveniently working from home as a salaried employee. This means that the ATO expects you to have an area of your home set aside exclusively for business purposes. Occupancy expenses are those expenses you pay to own, rent or use your home. These include:

- rent, or mortgage interest

- council rates

- land taxes

- house insurance premiums

You can generally claim the same percentage of occupancy expenses as the percentage area of your home that is used to make income, and again one common way to work this out is to use the floor area put aside for work as a proportion of the floor area of your home as a whole (as can be used for some running expenses, as mentioned above).

Note that where you are running a business from home rather than having a home office you can opt to claim occupancy expenses, such as mortgage interest. However, you’ll be expected to account for any capital gain attributable to the business area of the home when you sell the house. Generally, the family home is exempt from capital gains tax (CGT), but if you’ve carried on a business based on the above, that portion of the home attributable to the business activity will be subject to CGT.

Share this: