AGED CARE – SOME AREAS OF CONCERN AND WHAT FEES APPLY

Posted on September 22, 2017 by GSCPA AdminThere has been some recent media attention largely focused on the ‘exit fees and complex contracts’ associated with a particular retirement village. Unfortunately in my own dealings with aged care providers, there are concerns that need to be addressed across the industry.

In my experience you do need to carefully review the contract provided in relation to the purchase of a retirement villa, the Means Tested Assessment prepared by the Department of Human Services for admittance to an aged care facility needs to be checked and the annual and lifetime Means Tested Fees that may apply also need to be monitored. Some of the issues we have encountered include:

- Major errors in the Means Tested Assessments which impacts the monthly Means Tested Fees payable by the resident

- We recently obtained a refund of approximately $46,000 for a client as Income Tested fees had been charged instead of Means Tested Fees where the annual and lifetime cap had not been taken into consideration by the aged care provider

- Having to prove to an aged care facility that the Means Tested lifetime cap had been met for a resident by providing historical invoices. The monthly Means Tested fees were approximately $4,000 per month and continued to be charged for 6 months after the Life Time Cap had been reached which meant the resident was out of pocket approximately $24k whilst waiting for the refund. Unfortunately the fees are often paid as a direct debit and many people would not be aware when these caps apply.

We understand Centrelink advises the consumer and the aged care provider when the resident has reached their annual or lifetime caps. In my experience however there can be lengthy delays with Centrelink’s system. In one case the aged care provider had not been notified by Centrelink 9 months after the lifetime cap had been met for a resident. It is therefore important to monitor the payments made in excess of the cap and address delays directly with the provider and / or Centrelink through the Department of Human Services.

More information on the fees that may apply to you or a loved one are summarised below.

Please be aware that there is a clear distinction between a Retirement Village and a Residential Aged Care facility. A Retirement Village is open to those over 55 years of age and the majority of residents live in ‘independent living units’. Residential aged care facilities offer supported living for those who need daily personal assistance and cannot live alone. Some retirement villages are on the same site as aged care facilities which can make for a smoother transition or allow couples to be close when one can no longer be cared for in the villa.

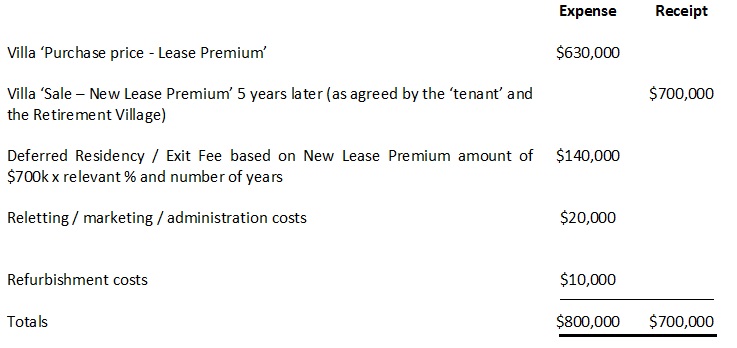

A retirement villa is generally ‘owned’ via a 99 year lease arrangement with ongoing management fees applicable. The contract with the Village sets out when and who you can sell the unit to when you exit, these contracts can be very complex and will include what fees can be charged when exiting. There are many variations on the exit fees charged by different providers, potentially 30% of the sale price or 50% of any ‘capital gain’ (the difference between the original ‘purchase price’ and new lease price). Below is a summary of an exit Statement from one provider:

If you are looking at aged care services there are lots of things to consider and options to explore. Importantly an assessment is required by health professionals who are members of an Aged Care Assessment team (“ACAT”). ACAT team members assess whether a person is in need of care and whether the care required is either low or high level care. This assessment is funded by the Australian Government and free of charge to the applicant.

Once approved by ACAT, the process of looking for an appropriate aged care home can begin. Please refer to the My Aged Care website for additional information which includes an aged care home finder service.

How much you could be asked to pay towards accommodation costs for aged care will depend on the financial situation of the person moving into care. New entrants to a residential aged care facility from 1 July 2014 are subject to a quarterly means test of both assets and income to determine the level of contributions they need to make towards the costs of both accommodation and ongoing health care. There are also subsidised home care services for older Australians who are eligible for residential aged care but prefer to remain at home.

Even if you have never previously dealt with the Department of Human Services / Centrelink, there is an Income and Assets Assessment form that determines the fees applicable to some care fees. If you do not complete and lodge the relevant Income and Assets Assessment Form, you will not be eligible for any Australian Government assistance towards your aged care costs. This may mean you are asked to pay the maximum accommodation payment agreed with the provider and the full cost of the care fees.

Accommodation Payments vary depending on the facility; an extra services provider could apply an Accommodation Payment of $875,000 for example for a single bedroom which includes an ensuite and small personal lounge room. Accommodation Payments can be upwards of $1,000,000.

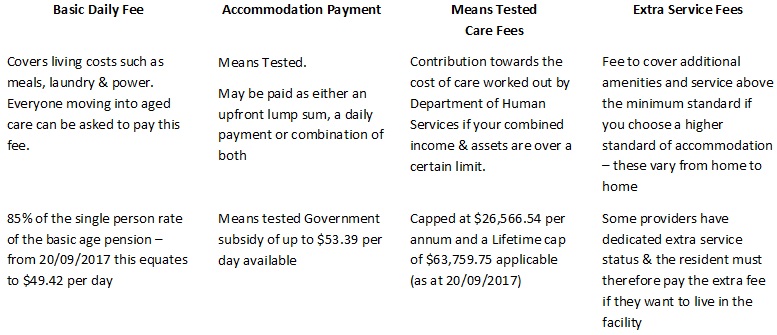

An aged care home may ask you to pay one or more of the following fees:

- Basic Daily Fee

- Accommodation Payment

- Means Tested Care fee

- Fees for Extra or additional services

A summary of the fees as at 30 June 2017 is provided in the following table together with further details on each type of payment below. Please be aware that the daily fees and Means Tested caps are indexed on 20 March and 20 September each year.

Basic Daily fee – contribution towards day to day living expenses such as meals, cleaning, laundry, electricity etc.

Accommodation Payment is made by either of the following or combination of both:

- Refundable Accommodation Contribution (RAC) or Refundable Accommodation Deposit (RAD)

- Daily Accommodation Contribution (DAC) or Daily Accommodation Payment (DAP) – rental type payment

The amount you can be asked to pay for your accommodation is based on your income and assets. If your income and assets are below a certain amount the Australian Government will pay your accommodation costs, you may need to pay for part of your accommodation or you may need to pay for the full cost of your accommodation.

A new resident will have up to 28 days after entering an aged care home to decide whether it be a lump sum refundable accommodation deposit (RAD), a daily accommodation payment (DAP) or a combination of both. If a RAD is chosen, the resident has up to 6 months after entry to pay allowing time to sell assets if required. In the interim a DAP is paid or if the accommodation payment cannot be paid in full, the maximum Permissible Interest Rate (MPIR) of 5.70% applies to the DAP.

The maximum amount of a RAD that a resident can be asked to pay must leave the resident with at least the minimum permissible asset level which is calculated as 2.25 times (rounded to the nearest $500) of the basic single age pension amount.

Means Tested Care fees – A resident’s obligation to contribute towards the cost of their ongoing health care is determined by the combined means testing of assets and income. Where a fee is applicable, these care fee payments are currently capped at $26,566.54 per annum with a current lifetime cap of $63,759.75.

For those in care prior to 1 July 2014, Income Tested Fees apply and the annual and lifetime caps are not applicable. Continuing residents will remain under their current fee arrangements unless they leave care for more than 28 days or move to a new facility and elect to be covered by the new arrangements.

Extra Service Fees apply if the facility has an extra service status associated with the provision of additional hotel type services and a higher standard of accommodation, food and services than the average provided by aged care homes. Extra Service does not mean that a higher level of care is provided.

Extra Services may include additional amenities such as provision of pay TV, wine with meals, meals prepared by a chef or cook on site, daily newspapers, regular outings, personal grooming and beauty services, Cinema room or sensory room.

The fees are charged on a daily basis and can be paid up to a month in advance as agreed with the aged care facility. Some aged care providers have dedicated extra service status and for these residents, the extra service fee is compulsory rather than optional.

A calculator is available on the My Aged Care website that provides estimates of the income tested fee payable and information on what assets are assessable under the Assets Test and the Income Test.

The first question for someone going into residential care is normally about their existing home. There are different considerations when one member of a couple can no longer be cared for at home and the need arises for entering residential aged care facility.

Should the need for aged care arise, the right planning will be beneficial for the resident and the estate. The impact of not properly understanding decisions made can be expensive.

This is a complex area. Please do not hesitate to contact Helen Cooper at our office should you require additional information.