Posted on May 5, 2017 by Andrew Sullivan

GeersSullivan has received its AFSL

As of 1 July 2016 all advisors who wanted to give advice on Superannuation were required by ASIC to hold an Australian Financial Services Licence (AFSL). Prior to that date all Accountants (in Public Practice) had the necessary skills and qualifications to advise clients on the establishment of Self Managed Super Funds, how much you could contribute, when to transition to retirement or when to draw a pension.

The application process was exhaustive and nearly 12 months since our application was submitted, ASIC has granted our licence.

Only 1,181 licences were applied for Australia wide and only 523 licences have been granted. To put this into perspective, there are 74,911 registered Tax Agents in Australia, meaning less than 0.7% are now able to give SMSF advice.

GeersSullivan has recognised for well over 10 years that SMSFs are a specialised area, which is why we have a specialised SMSF Team, led by the Directors of GeersSullivan and Helen Cooper, the Senior Manager of our SMSF Division. On 1 July 2016, ASIC implemented laws that recognised the same.

What does this mean?

GeersSullivan SMSF Advisory Pty Ltd now holds an AFSL which allows our Senior Team to continue to give advice on:

- The Establishment of a SMSF

- Making contributions to your SMSF

- The appropriateness of certain investments in your SMSF

- Transferring assets into your SMSF

- Borrowing in your SMSF

- Transitioning to retirement

- Starting a pension

- Structuring your fund to minimise the tax it pays both now and upon the passing of a member

Who can give advice?

Only those who hold an Australian Financial Services Licence or are authorised under a licence holder can give advice on SMSFs.

It is now illegal for anyone else to give advice on SMSFs. ASIC have already contacted hundreds of trustees of newly established SMSFs asking for information on who and how they were advised to establish their SMSF and penalising Accountants who gave unlicensed advice.

What is now required in order to give advice?

As a result of the laws imposed by ASIC, this is now the process for a licenced Advisor to give advice:

- Initial Meeting – we meet with you to discuss the services we are able to provide and the process required to allow us to provide advice to you

- Providing you with our Financial Services Guide (FSG)

- Fact Find – we need to gather information about you, to determine your current financial position and the financial goals you have

- Providing an Engagement Letter setting out the terms of SOA engagement and fee

- Statement of Advice – we prepare and then present to you our recommendations on the best way for you to proceed

- Implementation – upon your acceptance of the Statement of Advice, we will implement the agreed strategy

We really appreciate your referrals

We always appreciate the referrals we receive from our clients – it’s how our business has continued to be successful over the last 14 years.

To celebrate our new licence, for the next six months we would like to reward you for your referrals by sending you on a holiday.

If you refer a friend or family member of yours to us, who has an existing SMSF, we will send you and a travelling companion of your choice to either:

- Melbourne – staying at the Crown Metropol for 2 nights; or

- Crown Towers in Perth for 2 nights with a $1,000 Crown Voucher to enjoy during your stay or any other time over the next 12 months.

If you refer a friend or family member of yours to us, who establishes a SMSF with GeersSullivan, we will send you and a travelling companion of your choice to either:

- Singapore, staying at the Marina Bay Sands for 4 nights; or

- Bali, staying at the Seminyak Beach Resort for 5 nights.

*Please note that Terms & Conditions apply. Please contact our office for more details.

Share this:

Posted on March 9, 2017 by GSCPA Admin

The Australian Taxation Office introduced investment strategy requirements in 2012 which stated that Trustees of a self managed superannuation fund must consider whether insurance cover for the members of the fund is required. Trustees are expected to take into account the age of each member and any other insurance the members may already hold. Considering the insurance needs of SMSF members does not mean that you must purchase insurance within your SMSF.

You can purchase the following types of insurance within a self managed super fund:

- Life Insurance

- Total and permanent disability insurance (TPD)

- Income protection insurance

From 1 July 2014, the superannuation law prohibits the trustee of an SMSF from providing an insured benefit in relation to a member unless the insured event is consistent with a condition of release such as death, terminal medical condition, permanent incapacity or temporary incapacity.

Consequently from 1 July 2014 new trauma insurance cannot be taken out in superannuation as it is not consistent with one of the conditions of release. Care needs to be taken when any Total & Permanent Disablement policies or Income Protection policies are acquired within your fund to ensure they align with this requirement. Please note that these restrictions do not apply to continuing SMSF owned policies already in place as at 30 June 2014.

Below is a list of important points to take in to consideration (along with your personal circumstances) before deciding if purchasing insurance within you fund is the right choice for you.

Cash flow: When insurance is held within superannuation the premiums are paid by your SMSF which can help with personal cash flow. Because the insurance policy will be owned by your SMSF, it is your fund that will pay the premiums.

Tax deductibility of premiums: Superannuation funds are generally able to claim insurance premiums as a tax deduction for the fund (please refer to table below). The tax deduction is useful in reducing the tax payable by the fund and if the policies are held personally the premiums are generally not deductible by individuals. Please be aware that the policy owner must be the SMSF, that is the policy is held in the trustee’s name ‘as trustee’ of the fund in order for the fund to pay the premium and claim the premium as a deductible expense.

Ability to access funds: It is important to remember that any claims paid from insurance held within your fund will be paid to the SMSF and not directly to you or your beneficiaries. In order to be paid a claim and withdraw the policy proceeds from your SMSF, a ‘condition of release’ is met as summarised below:

- Death

- Permanent incapacity

- To meet the requirements of permanent incapacity, you must obtain reports from two registered medical practitioners, which confirm:

- The medical treatment is for an existing medical condition, which is currently:

- A life threatening illness or injury- A life threatening illness or injury is a medical condition where there is a likelihood to cause death within 24 months

- Causing acute or chronic pain, or

- An acute or chronic mental illness, and

- Acute refers to the rapid progress or onset of a condition suggesting urgency of treatment

- Chronic refers to a condition having indefinite duration

- The treatment is not readily available through the public health system.

- Temporary incapacity

- To meet the requirements of temporary incapacity you must have temporarily ceased work due to physical or mental ill health that does not constitute permanent incapacity.

- Generally, temporary incapacity benefits may be paid only from the insurance benefits such as an income protection insurance claim.

In some cases, where a condition of release cannot clearly be satisfied, it could result in insurance proceeds being stuck in the fund causing complications at an already stressful time.

Tax on benefits: Once a condition of release has been met, depending on the reason for the payment and depending on who is receiving the payment, there may be further tax consequences to consider. Such tax consequences need to be carefully examined prior to deciding to hold insurance cover through an SMSF as they could unwind many of the tax benefits enjoyed within the fund.

Lump sum death benefits paid to tax dependants are tax-free, tax dependants include:

- Spouse including same or opposite sex de facto or former spouse;

- Children – either under the age of 18 years old or a child that is financially dependant or a child with a disability;

- Any other person within an interdependency relationship with the deceased just before he or she died.

Lump sum death benefits including life insurance proceeds that are paid to non-dependants (for example, an adult child that does not fall in to the abovementioned categories), may be subject to tax depending on the member’s tax-free and taxable components and whether the life insurance premiums have been claimed as tax deductions. An element of the life insurance proceeds may be taxed as an untaxed element, this is subject to 30% tax plus the Medicare Levy where the premiums have been claimed. The calculations are determined using a statutory formula as set out in the Income Tax Assessment Act. Under the formula, the closer to deceased is to retirement the smaller the untaxed element will be. If no deduction is claimed there is no untaxed element.

To safeguard against any adverse tax consequences when life insurance is likely to be paid to a non-dependant, the premium can be paid by the self-managed super fund but no deduction claimed. Life Insurance proceeds paid to a non-dependant for which no deduction has been claimed, forms part of the deceased member’s taxable component which is subject to 15% tax (plus the Medicare Levy depending on whether paid to the estate or directly to a non-dependant).

Higher cost than industry funds: If you purchase insurance within your SMSF you may expect to pay a higher premium than if you obtained insurance offered from a larger industry fund. As larger funds purchase insurance in bulk and receive a discount from the insurance company which they pass on to their members.

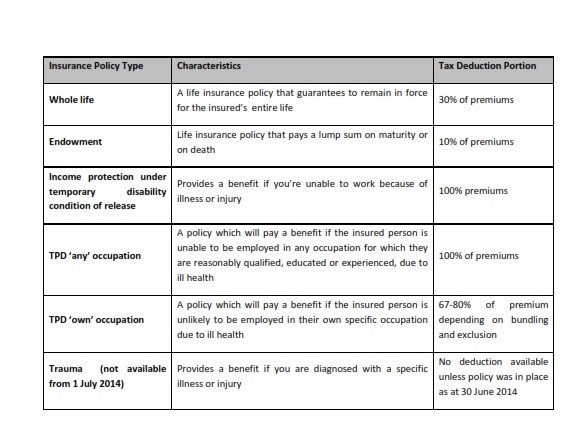

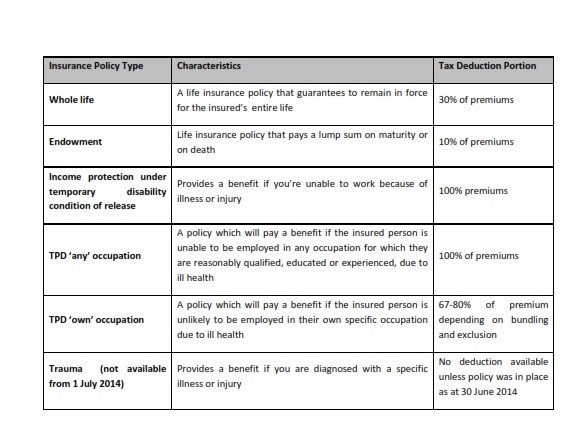

Tax deductibility of premiums: Depending on the type of insurance policy held, the SMSF trustee can claim the following tax deductions for any insurance policies held for the members:

Deductibility of different insurance policy types when held within your SMSF:

The above information is purely factual in nature and does not take in to account personal objectives, situations or needs. The information does not intend to imply any recommendation or opinion about a financial product and does not constitute financial product advice under the Corporations Act 2001. Careful consideration should be given to whether purchasing insurance via a superannuation fund is appropriate in each particular circumstance.

Share this: