Q & A – EMPLOYEE TERMINATION PAYMENTS – THE TAX IMPLICATIONS OF REDUNDANCY

Posted on February 1, 2017 by Ashley DawsonWhat is an Employee Termination Payment?

An Employee Termination Payment (ETP) is a lump sum payment made because your employment has finished with your employer. These payments have special tax treatments and can include the following:

- Payments for unused rostered days off;

- Payments in lieu of notice;

- A gratuity or ‘golden handshake’;

- Compensation payments i.e. for loss of job, personal injury, ill health.

However, for tax purposes, the following payments received will not be included in your termination payment as they will be included in your PAYG Payment Summary and taxed at your individual income tax rate:

- Lump sum payments for unused Annual or Long Service Leave

- Any salary or wages owing for work already completed

- The tax free part of any genuine redundancy payment

How are Employee Termination Payments Taxed?

ETP’s are taxed in special ways depending on the type of payment that has been received. The two different caps that apply to ETP’s are the ETP Cap and the Whole-of-Income Cap.

The ETP Cap

The ETP Cap is only used for ‘excluded payments’ (reasonably required payments by employers) that have been received which can include the following:

- Genuine Redundancy

- Early Retirement scheme’s

- Compensation Payments i.e. for injury, unfair dismissal, harassment.

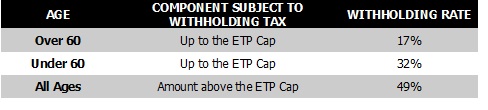

ETP’s are taxed at a lower rate up to a certain limit which is called the cap. The cap increases every year and for the 2016-2017 financial year the ETP Cap is $195,000. The following rates apply:

The Whole-of-Income Cap

The Whole-of-Income Cap only applies to ‘non-excluded payments’ (unrequired payments received by employers) that include the following:

- Payments that do not meet genuine redundancy rules;

- Gratuities or Golden Handshakes;

- Payments for rostered days off or unused sick leave.

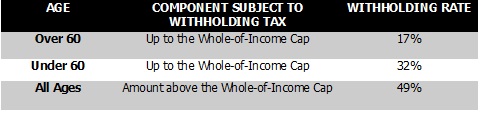

The Whole-of-Income Cap is $180,000 and is then further reduced by any taxable income received for the financial year. The following rates apply:

What happens to any accrued leave that I haven’t used yet?

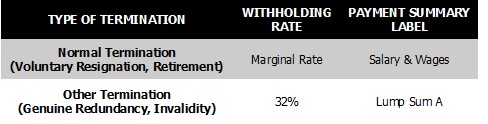

If your employment is terminated and you have unused annual or long service leave, this may receive concessional tax treatment and be taxed at rates up to 32%. Depending on the type of termination, you may have to include any accrued leave payments in your Salary & Wages when completing your return. See the below table on how to treat any leave payments received: