Posted on October 29, 2015 by Ashley Dawson

Q I read that under the six year rule an owner-occupied unit would not be subject to any capital gains tax even though it was rented out.

What would happen if I rented out my unit for five years and then moved back in? Can I live in the unit for a couple of months, then apply the six-year rule again and rent it out for a second time?

How long would I need to live in my unit each time before I started another rental period under the six-year rule?

A Each time you live in the property you would revive the six-year rule.

Just keep in mind that you must be actually living in it – this means having your bills sent to that address and doing all other things that a normal resident would do.

Q If I salary sacrifice in this financial year, is my employer obliged to put that amount into my super before the end of June, or can it be transferred in the next financial year?

A There is no requirement for the employer to have it in the super fund’s bank account by the end of the financial year – in fact, a large proportion of employer contributions are credited to the member’s account in the following financial year.

This can cause issues if you’re trying to maximise your concessional contributions as you could find that you under contribute in the current year and over contribute in the next. It would be worthwhile talking to your pay office to confirm when the money may be paid, so you can decide what action to take if necessary.

Q I am 64, and recently read that contributions can be made to a pension fund without opening another fund (accumulation).

If this is true; can I reinvest 75% of my compulsory pension withdrawal requirement from/to my pension fund? Will the ATO accept this?

A You cannot contribute to a superfund account in pension mode through an industry or retail type fund; a new super account would need to be established. If you have a self-managed super fund (SMSF) however the fund can have an accumulation member component, and a pension member component.

Contributions made to a SMSF will be credited to the accumulation component of your member account. An actuarial certificate will be required each year to ensure that the tax free income claimed is correct. A SMSF can have a maximum of 4 members so we often find one member of a SMSF is in Pension mode or transition to retirement whilst the other is in accumulation mode due to differences in age and/or their super account components.

Q My partner and I are 26, and our annual income including super is $135,000 – I work full time and my partner is currently working part time, looking for full-time work.

Our annual expenses total $42,500 including rent. We have $230,000 in a high-interest account, but are being charged a lot of additional tax on this. We want to own a home one day but don’t feel inclined to pay the prices people are asking at the moment.

We are thinking about moving a lot of this money into shares, but have no idea of the best way to do this, or even if that is the best approach. What are your thoughts on how we should invest our savings?

A You need to be aware that with moving the money into growth assets like shares, you will pay capital gains tax if you make a profit. You could also face a loss if the market is down at the time you decide to buy a property.

If you’re earning 3.5 per cent on your $230,000, the interest should be around $8000, and the maximum tax you would be paying based on your taxable income being between $80K – $180K should be around $3000. I think that’s a fairly small price to pay for the certainty of having the money available when you decided to buy.

Q. My mother has dementia and I am her full-time carer. She is on the single aged pension full rate, has no savings but owns her house outright. I live with her.

What will happen if I can longer care for her and she needs to go into a nursing home?

Will I be able to stay in the house, as I have nowhere to go and I am not claiming the carer’s pension?

A Aged-care expert Rachel Lane says the former home would be exempt from your mother for aged-care purposes if you are considered to be a “protected person”.

A protected person is a spouse or dependent child, a carer who has been living in the property for at least two years who is eligible to receive an Australian income support payment or a close relative who has been living in the property for at least five years who is eligible to receive an Australian income support payment.

You do not have to claim an Income support payment to meet the criteria, you just need to be eligible to receive it.

The former home will be exempt for your mother’s pension for up to two years after she moves into care. Beyond this period the house would be assessable as an asset and she would be considered a non-homeowner for pension purposes.

An indefinite exemption can be applied to the house and any rent received if your mother pays for her cost of aged-care accommodation by daily charges and rents the home.

If you have any pressing tax questions you need answered, please do not hesitate to contact any of our expert team at the office on (08)9316-7000.

Share this:

Posted on by GSCPA Admin

How much you could be asked to pay towards accommodation costs for aged care will depend on the financial situation of the person moving into care. If this is something that may impact you or your parents in the next 5 to 10 years, there are likely to be things that you should be doing sooner rather than later to ensure you have sufficient funds to cover the various aged care fees or reduce them.

This is a complex area. Financial advice needs to be obtained to determine the best option for your circumstances. GeersSullivan does not provide financial advice however our financial planning team at Lexington Financial Services can assist in this area.

New entrants to a residential aged care facility from 1 July 2014 are subject to a quarterly means test of both assets and income to determine the level of contributions they need to make towards the costs of both accommodation and ongoing health care. There are also subsidised home care services for older Australians who are eligible for residential aged care but prefer to remain at home.

An assessment is required by health professionals who are members of an Aged Care Assessment team (“ACAT”). ACAT team members assess whether a person is in need of care and whether the care required is either low or high level care. This assessment is funded by the Australian Government and free of charge to the applicant.

Once approved by ACAT, the process of looking for an appropriate aged care home can begin. Apart from the payments required by the facility, considerations to be addressed include:

- Accreditation and certification of the aged care home

- Financial stability of the provider

- The standard of the accommodation including amenities, qualified staff and staffing level

- Type of care and services provided, residency rules and rights

- Length of waiting period

Please refer to the My Aged Care website for additional information which includes an aged care home finder service.

Even if you have never previously dealt with the Department of Social Services / Centrelink, there is an Income and Assets Assessment form that determines the fees applicable to some care fees. If you do not complete and lodge the Income and Assets Assessment Form, you will not be eligible for any Australian Government assistance towards your aged care costs. This may mean you are asked to pay the maximum accommodation payment agreed with the provider and the full cost of the care fees. Accommodation Payments vary depending on the facility; an extra services provider could apply an Accommodation Payment of $875,000 for a single bedroom which includes an ensuite and small personal lounge room.

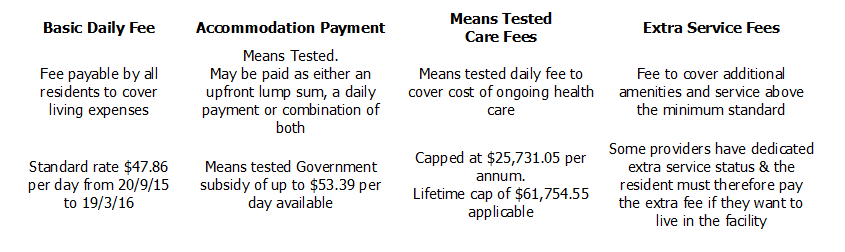

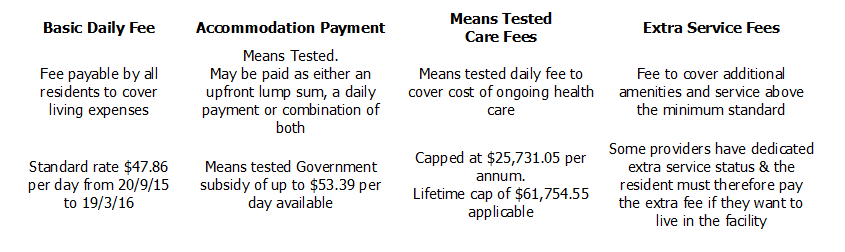

An aged care home may ask you to pay one or more of the following fees:

- Basic Daily Fee

- Accommodation Payment

- Means Tested Care fee

- Fees for Extra or additional services

A summary of the current fees is provided in the following table together with further details on each type of payment below. Please be aware that the daily fees increase on 20 March and 20 September each year in line with increases in the age pension amount and the Means Tested care fees are indexed annually.

It is worthwhile speaking to a financial adviser before completing any asset assessment forms.

Basic Daily fee

Contribution towards day to day living expenses such as meals, cleaning, laundry, electricity etc.

Accommodation Payment

Is made by either of the following or combination of both:

- Refundable Accommodation Deposit (RAD)

- Daily Accommodation Payment (DAP)

A new resident will have up to 28 days after entering an aged care home to decide whether it be a lump sum refundable accommodation deposit (RAD), a daily accommodation payment (DAP) or a combination of both. If a RAD is chosen, the resident has up to 6 months after entry to pay allowing time to sell assets if required. In the interim a DAP is paid.

The maximum amount of a RAD that a resident can be asked to pay must leave the resident with at least the minimum permissible asset level, currently $46,000 which is calculated as 2.25 times (rounded to the nearest $500) the basic single age pension amount at the time of entry.

Where a person does not have assets above $46,000 they would need to find an aged care facility with fully supported resident spaces available.

If the accommodation payment cannot be paid in full, the unpaid amount incurs interest. The Maximum Permissible Interest Rate is currently set at 6.15% as at 1 January 2015.

Means Tested Care fees

A resident’s obligation to contribute towards the cost of their ongoing health care is determined by the combined means testing of assets and income. The daily means tested amount is first applied towards the cost of accommodation with any remainder after deducting the maximum accommodation supplement applied towards the care fees. Therefore if the means tested amount is less than or equal to the maximum accommodation supplement, no care fee is payable.

Where a fee is applicable, Care fee payments are capped at $25,731.05 per annum currently with a lifetime cap of $61,754.55.

Extra Service Fees

From 1 July 2014 all aged care home providers will be able to offer additional amenities such as provision of pay TV, wine with meals and daily newspapers on an opt-in-opt-out basis and charge a fee to be agreed with the resident.

However some aged care providers have dedicated extra service status and for these residents, the extra service fee is compulsory rather than optional.

A calculator is available on the My Aged Care website that provides estimates of the income tested fee payable and information on what assets are assessable under the Assets Test and the Income Test.

Amongst all the discussion around retirement savings and how Australians should position their investments, little is said about Australians who are nearing their life expectancy, and how the expected cost of residential aged care should influence investment choices.

The first question for someone going into residential care is normally about their existing home. The decision that is made can have a significant impact on the financial outcomes for the resident.

Putting aside all discussion around emotional or sentimental aspects around what happens to the property is one thing; getting to the bottom of the financial impacts is also complicated. There are different considerations when one member of a couple can no longer be cared for at home and the need arises for entering residential aged care facility.

Should the need for aged care arise, the right planning will be beneficial for the resident and the estate. There are strategies that can be considered to minimise means tested fees.

Getting your strategy right is complex. The impact of not properly understanding decisions made can be expensive.

Please do not hesitate to contact our office or Lexington Financial Services directly on 9316 9066 should you require additional information.

Share this: