Posted on September 15, 2015 by Ashley Dawson

From 1 July 2015, the Payroll Tax Assessment Act was amended and a new gradual diminishing tax-free threshold was introduced.

The annual tax-free threshold will be gradually phased out for employers or groups of employers with annual taxable wages in Australia between $800,000 to $7.5 million.

So what does this mean for you?

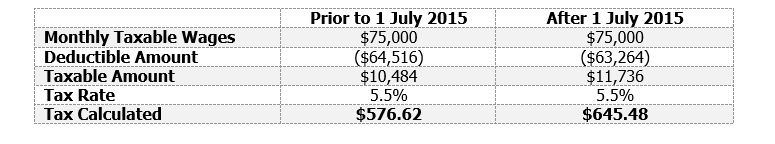

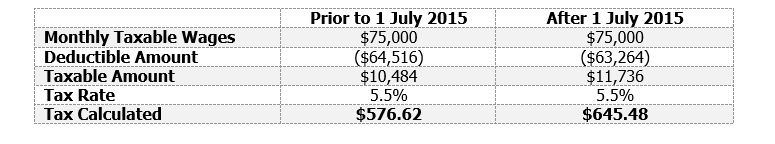

The deductible amount, which is the amount you may be entitled to deduct from your taxable wages is now calculated using a tapering value formula. The amount deductible has been reduced and therefore your monthly payroll tax liability will increase. It is important to be aware of these changes so that you can account for them in your cashflow.

The information below illustrates the effect of the new changes based on monthly taxable wages in WA of $75,000.

Share this:

Posted on April 16, 2015 by Chris Grieve

Each year both Jay and Chris look forward to heading to the East Kimberley region to visit clients and (if the opportunity presents itself) see some of the local tourist attractions. They consider themselves very fortunate to have a number of long standing clients in the town of Kununurra.

After a busy schedule over three days, a very generous client offered to take the two city slickers out fishing for some local Barramundi. We are sure the locals found it amusing as Jay and Chris marvelled at the breathtaking beauty of the region and giggled like young children as they pulled in a Barra. A quick trip out to Lake Argyle was also a highlight and highly recommended should you get the chance to visit the region.

To all our clients in Kununurra who are fortunate enough to have such natural beauty on their doorstep we thank you for your ongoing support, your hospitality and look forward to seeing you all again soon.

Share this: