Changes to WA Payroll Tax

Posted on 15th September 2015 by Ashley Dawson

From 1 July 2015, the Payroll Tax Assessment Act was amended and a new gradual diminishing tax-free threshold was introduced.

The annual tax-free threshold will be gradually phased out for employers or groups of employers with annual taxable wages in Australia between $800,000 to $7.5 million.

So what does this mean for you?

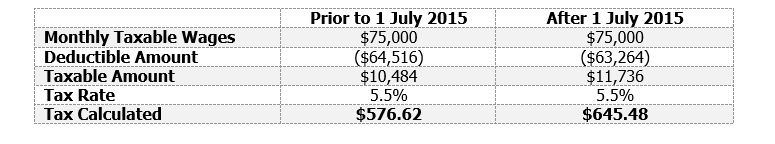

The deductible amount, which is the amount you may be entitled to deduct from your taxable wages is now calculated using a tapering value formula. The amount deductible has been reduced and therefore your monthly payroll tax liability will increase. It is important to be aware of these changes so that you can account for them in your cashflow.

The information below illustrates the effect of the new changes based on monthly taxable wages in WA of $75,000.