Home Office Expenses

Posted on 27th November 2018 by Ashley Dawson

Recently the Australian Taxation Office (ATO) has updated their on-line guidance in relation to home office expenses for both, employees working from home and for businesses being operated from home. The biggest change to the guidance is the requirement for a taxpayer to maintain at least a 4 week diary of home office use that is representative of the whole of the year or otherwise keep records of actual work related home office use for the whole year, if you are claiming home running costs under the fixed rate method.

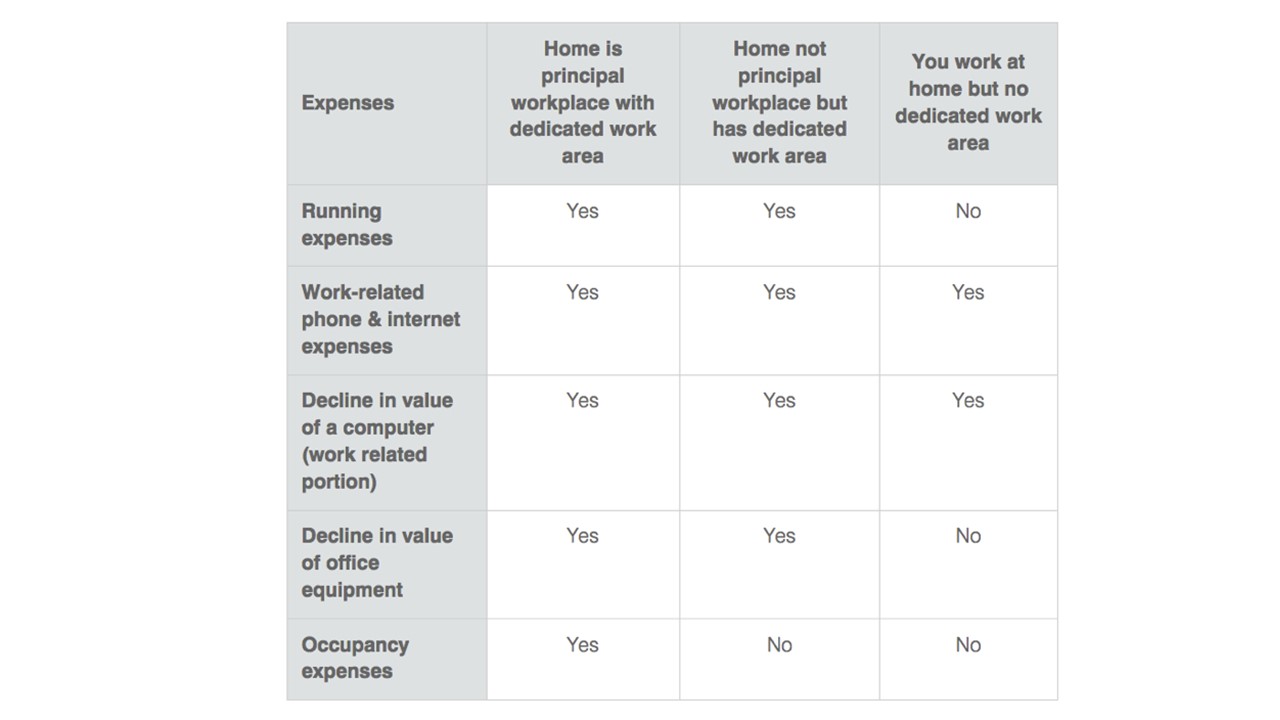

Below is a table from the ATO guidance that shows what can and cannot be claimed under the different working scenarios:

Home office running expenses include the following:

- home office equipment

- Electricity and gas expenses

- the costs of repairs to your home office equipment, furniture and furnishing

- cleaning cost

- printing and stationery costs.

There are two methods that an employee can use to calculate their home office expenses deduction:

- fixed rate method, or

- actual method

Under the fixed rate method, the deduction is calculated by multiplying the number of hours that you used the office for work during the financial year by the fixed rate, which is currently is 45 cents. The ATO requires that you maintain records of actual usage for the whole year or you can maintain a 4 week diary of the work usage of the home office that is representative of the whole year.

Under the actual method, you need to maintain records of all running cost expenses for the year and calculate the percentage of office floor space in relation to the total floor space of the house, which is then multiplied by the percentage of that you used the office for work during the year.

The only time an employee can claim a tax deduction for home occupancy expenses, such as rent, mortgage interest, insurance, and rates, is if an employer provides no other work location for the employee and the employee is required to dedicate part of their home to their employer’s business as an office. It is important to note that should you claim home occupancy costs as a tax deduction for part of your home then you will be ineligible for the use of the main residence exemption for CGT purposes on that part of the home when you sell it.

If you are running your business from home, such as a dentist surgery or hairdressing salon, the following expenses are tax deductable:

- utility expenses, such as gas and electricity – which must be apportioned between business and private use, based on actual usage

- business phone costs

- depreciation on the office plant and equipment, such as desks, chairs, computers – which must be apportioned between business and private use

- depreciation of the curtains, carpets and light fittings of the room that is being used solely for business purposes

- occupancy expenses, such as rent, mortgage interest, insurance, and rates – apportioned between business and private use based on floor area that is being used for business as a proportion of the whole floor area of your home.

Again, it is important to note that the full main residence exemption will not apply if your home is your principal place of business.