LMITO – Where’s my extra $1,080 promised by Prime Minister Scott Morrison?

Posted on 13th September 2019 by GSCPA Admin

Leading up to our recent federal election there was a great hype around changes to our tax system, none more enticing than the promise that every day Australians could expect to receive an additional $1,080 back from their next tax return through the introduction of the Low and Middle Income Tax Offset (LMITO).

A tax offset does not operate like a deduction, which most people are more familiar with. A deduction is used to reduce your assessable income (total wages, interest, dividends received, etc.) down to your taxable income. Which is the amount your tax bill (payable) for the year is derived from. A tax offset is applied as a reduction to your tax payable, meaning that, per dollar, it is more effective at reducing your tax position.

Unfortunately, this promise was without reference to some of the grittier details which stripped back how many people would actually receive the full value of this extra offset.

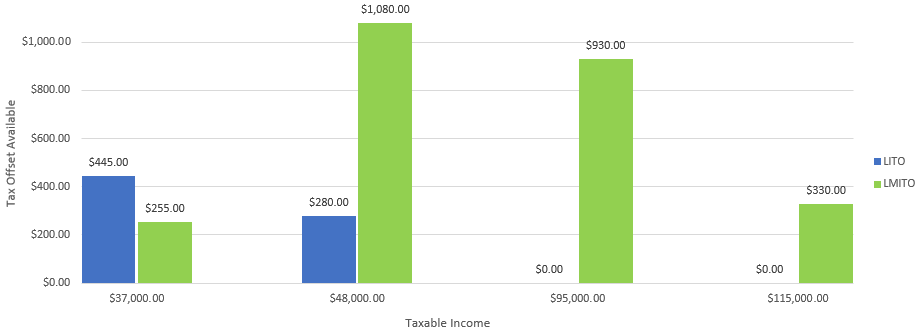

The offset operates in addition to the Low Income Tax Offset (LITO), which has been in place since 1993. The maximum offset available through LITO is $445, this applies if your taxable income is $37,000 or less. The offset however diminishes at $0.015 for every $1 your taxable income is over $37,000. Meaning it is fully depleted once your taxable income reaches $66,667.

Now with the new LMITO in place there is an extra offset available up to the value of $1,080 for taxpayers. It, like LITO operates on a sliding scale, but with multiple tiers added to its application. The first tier is for individuals with a taxable income less than $37,000, who will receive an extra $255 tax offset. The second tier is for taxable incomes between $37,000 and $48,000, who receive an offset of $255 plus $0.075 for every dollar their taxable income is over $37,000, up to $48,000, where you will be entitled to the full $1,080 tax offset. The full value of the offset is then held through the third tier up to a taxable income of $90,000, meaning that if your taxable income is between $48,000 to $90,000 you are entitled to the full $1,080 tax offset. However, once your taxable income exceeds $90,000 your offset entitlement is diminished by $0.03 of every extra dollar of taxable income, up until a taxable income of $126,000, when the offset has been completely diminished.

There are some drawbacks however, the offset is “non-refundable” meaning that if you don’t use the full value of your entitlement it’s not available as a straight up cash refundable amount. This would only occur if application of the offset reduced your taxable income to $0.00. Do remember that if you have another outstanding debt with the ATO or any Australian Government agency the ATO is required by law to remit your now larger refund toward these debts.

If you have any further questions regarding this new item please be in touch with your accountant at GeersSullivan on (08) 9316 7000.