Q & A – Home Office Expenses

Posted on 1st November 2016 by Kelsi Keep

Q: Can I claim a deduction for home expenses if I work from home occasionally?

A: Yes, for your home office expenses you can:

- Use a fixed rate of 45 cents for each hour of work you perform from home. This rate is designed to cover the cost of heating, cooling, lighting and the decline in value of furniture in your home office.

OR

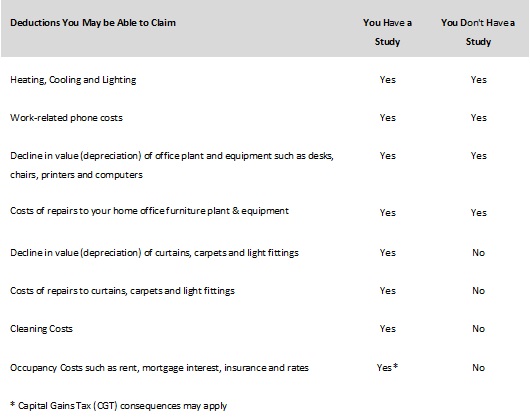

- Use the work-related proportion of the actual costs of the office. The deductions you can claim depend on whether or not you have a room such as a study or spare room that is set aside primarily or exclusively for work activities.

The following table sets out the deductions you may be able to claim:

Q: Do I need to keep any records in order to claim Home Office Expenses?

A: Yes, you must keep records of home expenses, such as:

- Receipts or other written evidence of your expenses;

- Itemised phone accounts from which you can identify work-related calls, or other records, such as diary entries if you do not get an itemised account from your phone company;

- A diary you have created to work out how much you used your equipment, home office and phone for business purposes over a representative four-week period.