Tax Implications for non Residents

Posted on 1st August 2017 by Ashley Dawson

Q: Am I a non-resident for tax purposes?

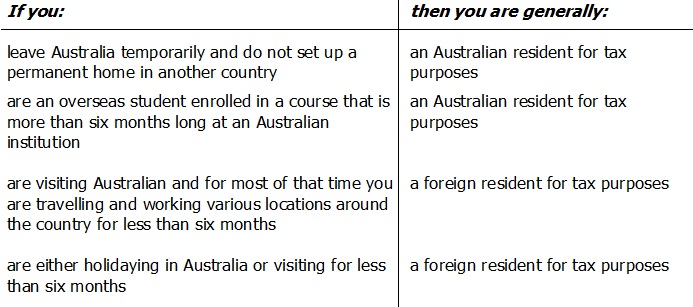

A: The ATO do not use the same rules as the Department of Immigration when determining your residency status. You can still be a resident for tax purposes even without being an Australian Citizen.

Below are some common situations that often apply when determining if you are an Australian resident or a non-resident for tax purposes:

Q: What do I have to declare in my tax return if I am a non-resident?

A: If you have been confirmed as a non-resident for tax purposes, you must declare any income earned in Australia including the following:

- Employment or wages income;

- Australian pensions or annuities;

- Rental Income;

- Any capital gains on Australian assets.

If you have a Higher Education Loan Program (HELP) or a Trade Support Loan (TSL) entered into while acting as a non-resident for tax purposes, you will need to declare your worldwide income or lodge a non-lodgement advice form.

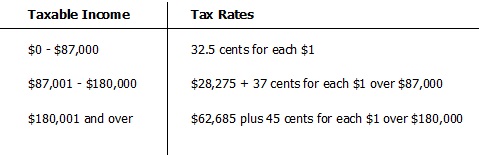

Q: What tax rates apply if I am a non-resident for tax purposes but have earnt income from an Australian source?

A: For the 2016-2017 financial year, the following rates apply for individuals who are non-residents for tax purposes:

It is important to note that non-residents are not required to pay the Medicare Levy. However the Temporary Budget Repair Levy is still payable at a rate of 2% for taxable incomes over $180,000.