When Can you Access Your Superannuation?

Posted on 30th July 2021 by Ashley Dawson

The purpose of your superannuation is to help fund your retirement. To help ensure that you use your super savings for retirement purposes, the government has legislated age and other restrictions on when you can access super.

Generally, you can access your super once you have reached your ‘preservation age’ and have permanently retired.

Importantly, should your circumstances change, it is possible to return to work once you have retired however you may be restricted from accessing any new entitlements until you meet a new condition of release (such as reaching age 65). The funds that you have already gained access to through your previous retirement will remain available to you.

There are also very limited circumstances where you can access your super early. These circumstances are mainly related to specific medical conditions, severe financial hardship, COVID-19 (novel coronavirus), or the First home super saver scheme.

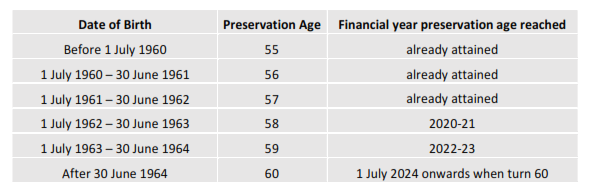

Your preservation age depends on when you were born as detailed in the table below:

Accessing your super as a transition to retirement (TTR) income stream

If you’ve reached your preservation age but haven’t permanently retired, you may be able to access some of your super via a transition to retirement pension (TTR).

A TTR involves drawing down on your super as an income stream but not as a lump sum. There are restrictions on the maximum amount of super you can withdraw each financial year as a TTR income stream. For example, if you are under 65 years old (and have reached your preservation age), you can currently access between 2–10% of the balance of money in your super account each financial year.

Accessing your super when you reach age 65

When you turn 65, you will generally have full access to your super, even if you continue working. There aren’t any additional conditions you need to meet to gain full access to your super, and in most cases, you can also choose not to withdraw any super.

Accessing your super early

In very limited circumstances, you can access super prior to reaching your preservation age. Some of these are briefly discussed below.

COVID-19 early release of superannuation:

Eligible citizens and permanent residents of Australia and New Zealand could apply up to 31 December 2020 when the program closed.

Access on compassionate grounds:

You may be allowed to withdraw some of your super on compassionate grounds for unpaid expenses where you have no other means of paying for these expenses.

The amount of super you can withdraw is limited to what you reasonably need to meet the unpaid expense.

Compassionate grounds includes needing money to pay for:

- medical treatment and medical transport for you or your dependant

- palliative care for you or your dependant

- making a payment on a home loan or council rates to prevent you losing your home

- modifying your home or vehicle or buying disability aids to cater for the severe disability of you or your dependant

- expenses associated with the death, funeral or burial of your dependant.

Access due to severe financial hardship

You may be able to withdraw some of your super if you meet both of these conditions:

- You have received eligible government income support payments continuously for 26 weeks, and

- You are not able to meet reasonable and immediate family living expenses.

If you’re under your preservation age, the minimum amount that can be withdrawn is $1,000 and the maximum amount is $10,000. If your super balance is less than $1,000 you can withdraw up to your remaining balance after tax. You can only make one withdrawal in any 12-month period.

However, if you have reached your preservation age plus 39 weeks and you are not gainfully employed when you apply, there are no cashing restrictions.

Access due to a terminal medical condition

You may be able to access your super if you have a terminal medical condition. All of the following conditions are required to be met:

- Two registered medical practitioners have certified, jointly or separately, that you suffer from an illness or injury that is likely to result in death within 24 months of the date of signing the certificate.

- At least one of the registered medical practitioners is a specialist practising in an area related to your illness or injury.

- The 24-month certification period has not ended.

Access due to temporary incapacity

You may be able to access your super if you are temporarily unable to work, or need to work less hours, because of a physical or mental medical condition.

Access due to permanent incapacity

You may be able to access your super if you are permanently incapacitated.

Your fund must be satisfied that you have a permanent physical or mental medical condition that is likely to stop you from ever working again in a job you were qualified to do by education, training or experience.

You can receive the super as either a lump sum or as regular payments (income stream).

First home super saver scheme (FHSS)

To help you save for your first home, you can apply to release voluntary concessional (before-tax) and voluntary non-concessional (after-tax) contributions you have made to your super fund since 1 July 2017.

You must meet the following eligibility requirements to apply for the release of these amounts:

- must be at least 18 years old

- must have never owned property in Australia – this includes an investment property, vacant land, commercial property, a lease of land in Australia, or a company title interest in land in Australia (unless the Commissioner of Taxation determines that you have suffered a financial hardship)

- not previously requested the Commissioner to issue an FHSS release authority in relation to the scheme

Eligibility is assessed on an individual basis. This means that couples, siblings or friends can each access their own eligible FHSS contributions to purchase the same property. (Note – If anyone has previously owned a home, it will not stop anyone else who is eligible from applying).

You can apply to have a maximum of $15,000 of your voluntary contributions from any one financial year included in your eligible contributions to be released under the FHSS scheme, up to a total of $30,000 contributions across all years. You will also receive an amount of earnings that relate to those contributions.

It is important to remember that there are many issues to consider when accessing superannuation entitlements including, but not limited to, tax and Commonwealth Aged Pension implications.

Please contact any of our Directors or Managers on 08 9316 7000 should you wish to discuss your specific circumstances in more detail.

Any information provided in this article is general in nature and does not take into account your personal objectives, situation or needs. The information is objectively ascertainable and was not intended to imply any recommendation or opinion about a financial product. This does not constitute financial produce advice under the Corporations Act 2001.